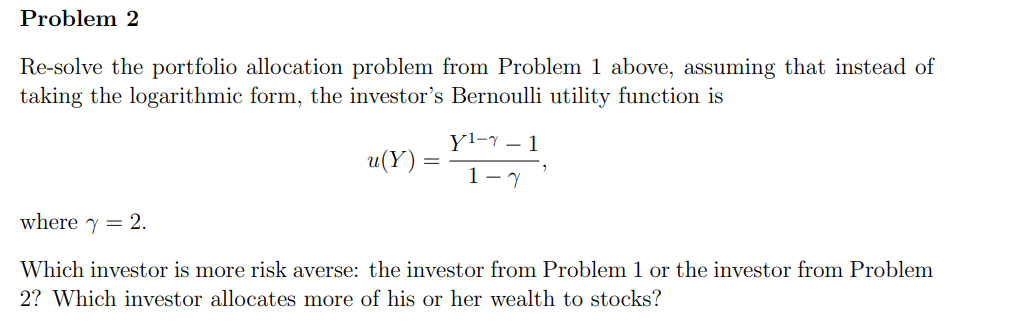

Question: Re-solve the portfolio allocation problem from Problem 1 above, assuming that instead of taking the logarithmic form, the investor's Bernoulli utility function is u(Y)=1Y11, where

Re-solve the portfolio allocation problem from Problem 1 above, assuming that instead of taking the logarithmic form, the investor's Bernoulli utility function is u(Y)=1Y11, where =2. Which investor is more risk averse: the investor from Problem 1 or the investor from Problem 2? Which investor allocates more of his or her wealth to stocks? Re-solve the portfolio allocation problem from Problem 1 above, assuming that instead of taking the logarithmic form, the investor's Bernoulli utility function is u(Y)=1Y11, where =2. Which investor is more risk averse: the investor from Problem 1 or the investor from Problem 2? Which investor allocates more of his or her wealth to stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts