Question: Resolving Errors and Correcting a Trial Balance Assume we examine the accounts of Century Inc. and identify the following errors. 1. Equipment purchased for

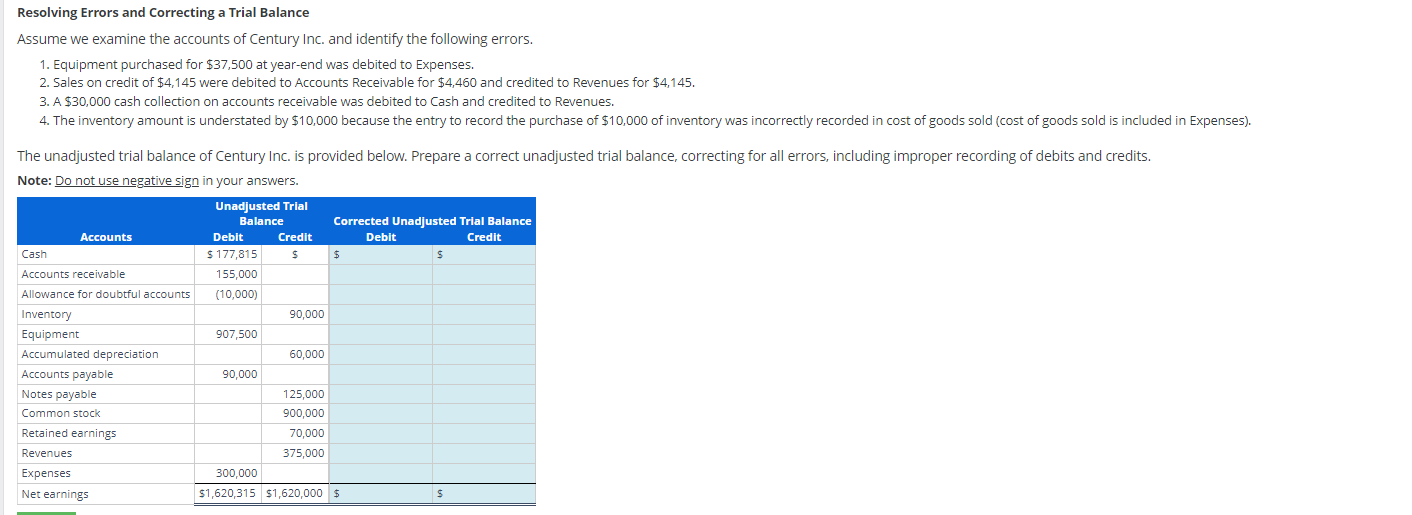

Resolving Errors and Correcting a Trial Balance Assume we examine the accounts of Century Inc. and identify the following errors. 1. Equipment purchased for $37,500 at year-end was debited to Expenses. 2. Sales on credit of $4,145 were debited to Accounts Receivable for $4,460 and credited to Revenues for $4,145. 3. A $30,000 cash collection on accounts receivable was debited to Cash and credited to Revenues. 4. The inventory amount is understated by $10,000 because the entry to record the purchase of $10,000 of inventory was incorrectly recorded in cost of goods sold (cost of goods sold is included in Expenses). The unadjusted trial balance of Century Inc. is provided below. Prepare a correct unadjusted trial balance, correcting for all errors, including improper recording of debits and credits. Note: Do not use negative sign in your answers. Unadjusted Trial Balance Corrected Unadjusted Trial Balance Accounts Debit Cash $177,815 Credit $ Debit Credit $ $ Accounts receivable 155,000 Allowance for doubtful accounts (10,000) Inventory 90,000 Equipment 907,500 Accumulated depreciation 60,000 Accounts payable 90,000 Notes payable 125,000 Common stock Retained earnings Revenues Expenses 900,000 70,000 375,000 300,000 Net earnings $1,620,315 $1,620,000 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts