Question: Hopper Flights Ltd is an airline that provides low-fare flights between major cities in the SADC region. Company management is considering acquiring Air Logistics

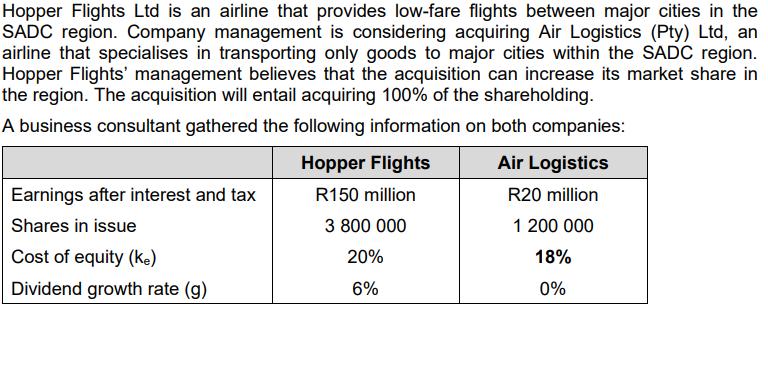

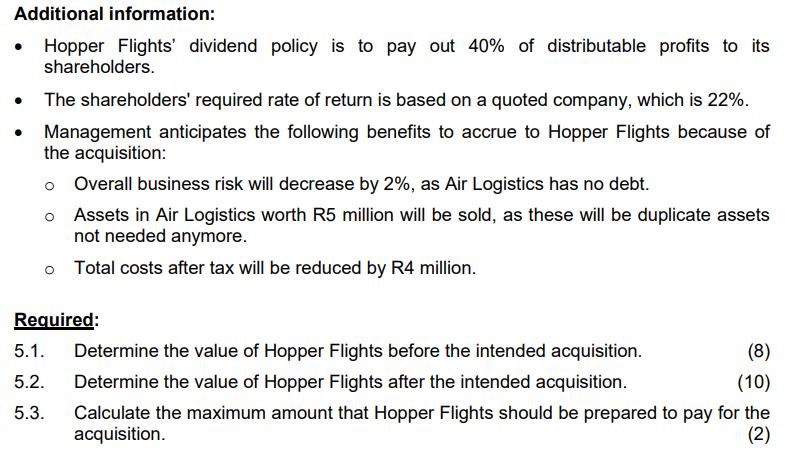

Hopper Flights Ltd is an airline that provides low-fare flights between major cities in the SADC region. Company management is considering acquiring Air Logistics (Pty) Ltd, an airline that specialises in transporting only goods to major cities within the SADC region. Hopper Flights' management believes that the acquisition can increase its market share in the region. The acquisition will entail acquiring 100% of the shareholding. A business consultant gathered the following information on both companies: Earnings after interest and tax Shares in issue Cost of equity (ke) Dividend growth rate (g) Hopper Flights R150 million 3 800 000 20% 6% Air Logistics R20 million 1 200 000 18% 0% Additional information: Hopper Flights' dividend policy is to pay out 40% of distributable profits to its shareholders. The shareholders' required rate of return is based on a quoted company, which is 22%. Management anticipates the following benefits to accrue to Hopper Flights because of the acquisition: o Overall business risk will decrease by 2%, as Air Logistics has no debt. o Assets in Air Logistics worth R5 million will be sold, as these will be duplicate assets not needed anymore. o Total costs after tax will be reduced by R4 million. Required: (8) 5.2. (10) 5.1. Determine the value of Hopper Flights before the intended acquisition. Determine the value of Hopper Flights after the intended acquisition. Calculate the maximum amount that Hopper Flights should be prepared to pay for the acquisition. (2) 5.3.

Step by Step Solution

3.34 Rating (178 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below 51 Determining the Value of Hopper Flights Before the Intended Acquisition The value of Hopper Flights before the intended acquisition can ... View full answer

Get step-by-step solutions from verified subject matter experts