Question: Responses and what was marked correct and incorrect from your previous attemp January February March Receipts $518,000 402,000 457,000 payments $465,900 349,900 524,000 According to

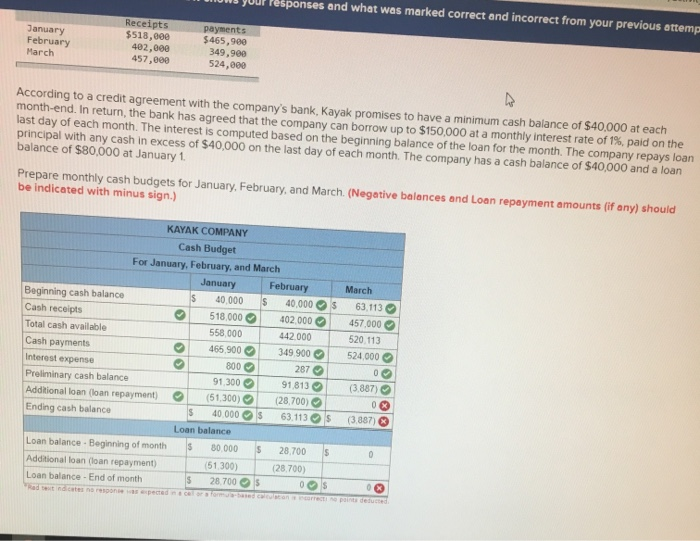

Responses and what was marked correct and incorrect from your previous attemp January February March Receipts $518,000 402,000 457,000 payments $465,900 349,900 524,000 According to a credit agreement with the company's bank, Kayak promises to have a minimum cash balance of $40,000 at each month-end. In return, the bank has agreed that the company can borrow up to $150,000 at a monthly interest rate of 1%, paid on the last day of each month. The interest is computed based on the beginning balance of the loan for the month. The company repays loan principal with any cash in excess of $40,000 on the last day of each month. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1, Prepare monthly cash budgets for January, February, and March (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) > KAYAK COMPANY Cash Budget For January, February, and March January February March Beginning cash balance $ 40.000 s 40.000 $ 63.113 Cash receipts 518.000 402.000 457.000 Total cash available 558.000 442.000 520.113 Cash payments 465.900 349 900 524 000 Interest expense 800 287 0 Preliminary cash balance 91.300 91813 (3.887) Additional loan (loan repayment (51,300) (28.700) 0 X Ending cash balance S 40.000$ 63.113S (3.887) Loan balance Loan balance. Beginning of month S 80.000 $ 28.700 S 0 Additional loan (loan repayment) (51 300) (28.700) Loan balance - End of month $ 28.7005 0S 03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts