Question: - retail CASE STUDY 4 FORMULATING A SIX-MONTH PLAN the buyer for the activewear department started to develop the merchandise n the buyer for t

-

- retail

retail

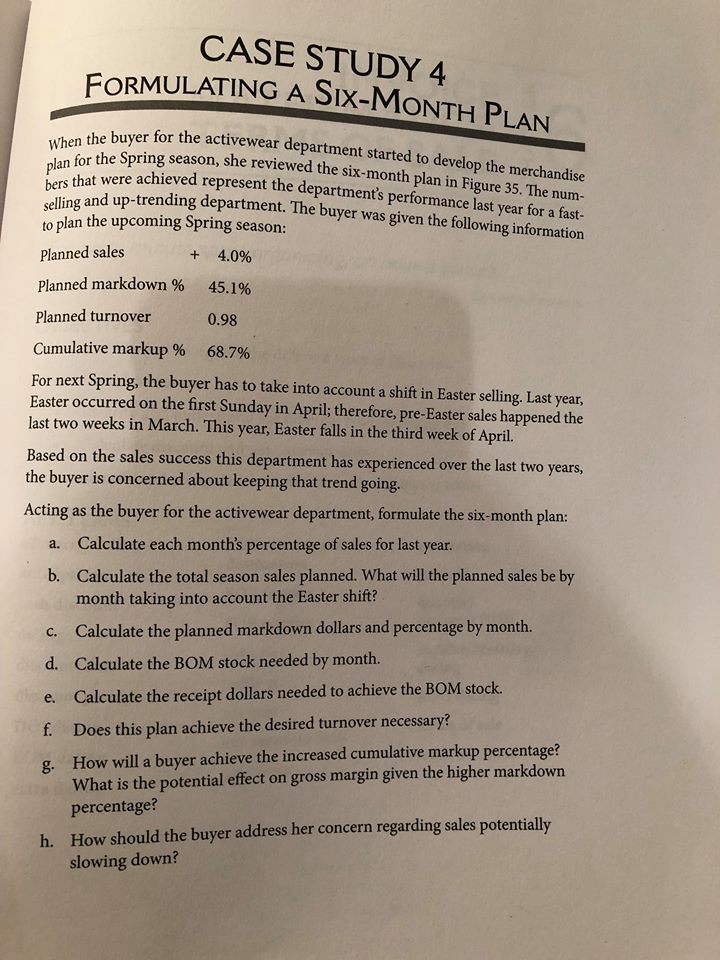

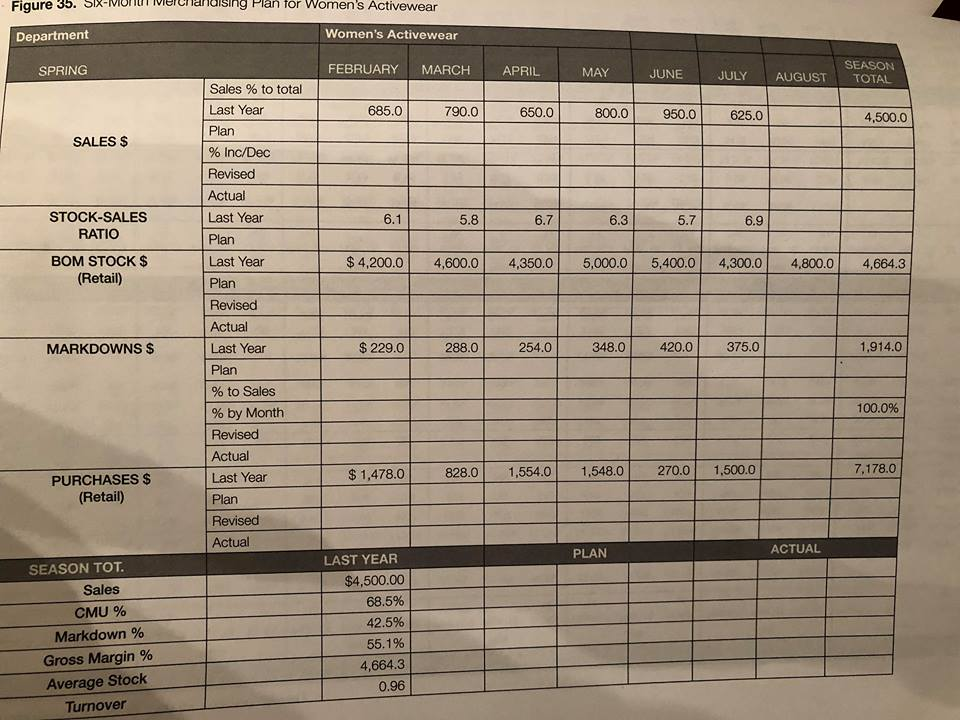

CASE STUDY 4 FORMULATING A SIX-MONTH PLAN the buyer for the activewear department started to develop the merchandise n the buyer for t ig season, she reviewed the six-month plan in Figure 35. The num- that were achieved represent the departments performance last year for a fast- plan for bers and up-trending department. The buyer was given the following information to plan the upcoming Spring season: Planned sales Planned markdown % 45.1% Planned turnover o.98 Cumulative markup % 68.7% For next Spring, the buyer has to take into account a shift in Easter selling. Last year, Easter occurred on the first Sunday in April; therefore, pre-Easter sales happened the last two weeks in March. This year, Easter falls in the third week of April. 4.0% Based on the sales success this department has experienced over the last two years, the buyer is concerned about keeping that trend going. Acting as the buyer for the activewear department, formulate the six-month plan: Calculate each month's percentage of sales for last year. Calculate the total season sales planned. What will the planned sales be by month taking into account the Easter shift? a. b. c. Calculate the planned markdown dollars and percentage by month. d. Calculate the BOM stock needed by month. e. Calculate the receipt dollars needed to achieve the BOM stock. f. Does this plan achieve the desired turnover necessary? g. How will a buyer achieve the increased cumulative markup percentage? What is the potential effect on gross margin given the higher markdown percentage? How should the buyer address her concern regarding sales potentially slowing down? h

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts