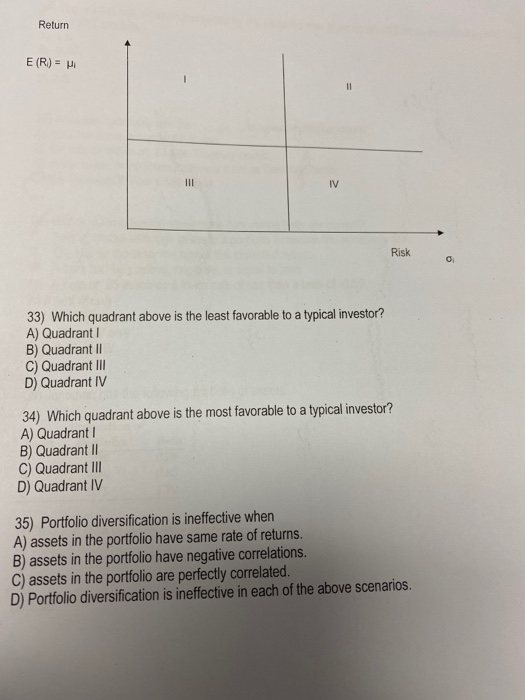

Question: Return E (R) = Risk 33) Which quadrant above is the least favorable to a typical investor? A) Quadrant 1 B) Quadrant II C) Quadrant

Return E (R) = Risk 33) Which quadrant above is the least favorable to a typical investor? A) Quadrant 1 B) Quadrant II C) Quadrant III D) Quadrant IV 34) Which quadrant above is the most favorable to a typical investor? A) Quadrant 1 B) Quadrant II C) Quadrant III D) Quadrant IV 35) Portfolio diversification is ineffective when A) assets in the portfolio have same rate of returns. B) assets in the portfolio have negative correlations. C) assets in the portfolio are perfectly correlated. D) Portfolio diversification is ineffective in each of the above scenarios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts