Question: Return on equity is not 27.35% or 27.36%. Please write the steps to find what the correct return on equity should be. Every other step

Return on equity is not 27.35% or 27.36%. Please write the steps to find what the correct return on equity should be. Every other step is already correct.

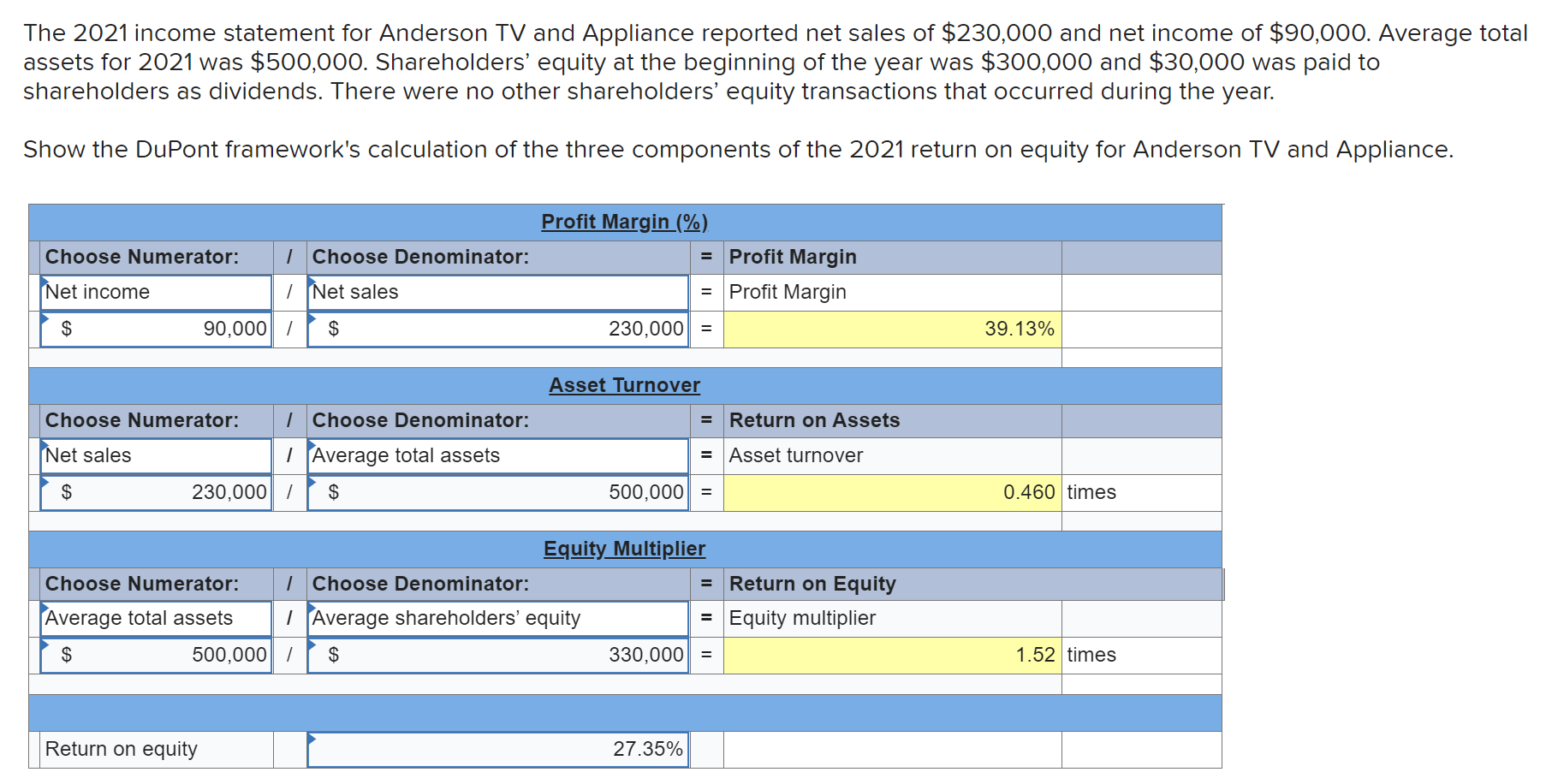

The 2021 income statement for Anderson TV and Appliance reported net sales of $230,000 and net income of $90,000. Average total assets for 2021 was $500,000. Shareholders' equity at the beginning of the year was $300,000 and $30,000 was paid to shareholders as dividends. There were no other shareholders' equity transactions that occurred during the year. Show the DuPont framework's calculation of the three components of the 2021 return on equity for Anderson TV and Appliance. Choose Numerator: | Choose Denominator: Profit Margin (%) = Profit Margin = Profit Margin Net income I Net sales $ 90,000 $ 230,000 = 39.13% Asset Turnover Choose Numerator: | Choose Denominator: Return on Assets Net sales = Asset turnover | Average total assets 230,000/ $ $ 500,000 = 0.460 times = Equity Multiplier Choose Numerator: | Choose Denominator: Return on Equity Average total assets | Average shareholders' equity = Equity multiplier $ 500,000/ $ 330,000) = 1.52 times Return on equity 27.35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts