Question: Return to question 4 Problem 3-12 Duration Assume coupons are paid annually. Here are the prices of three bonds with 10-year maturities. Assume face value

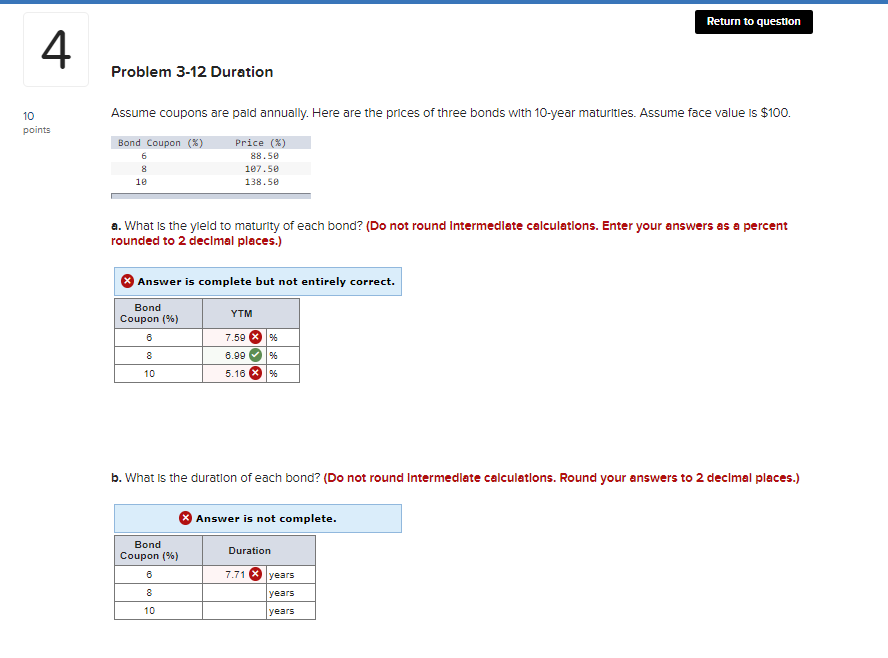

Return to question 4 Problem 3-12 Duration Assume coupons are paid annually. Here are the prices of three bonds with 10-year maturities. Assume face value is $100. 10 points Bond Coupon (%) 6 Price (%) 88.50 107.50 138.50 10 a. What is the yield to maturity of each bond? (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Answer is complete but not entirely correct. YTM Bond Coupon (%) 6 7.59 X % 8.99 8 10 5.16 X % b. What is the duration of each bond? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Answer is not complete. Duration Bond Coupon (%) 6 8 7.71 X years years years 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts