Question: Return to question 9 Problem 7-15 (Static) Troubled debt restructuring (Appendix 7B] 2.24 points Rothschild Chair Company, Inc., was Indebted to First Lincoln Bank under

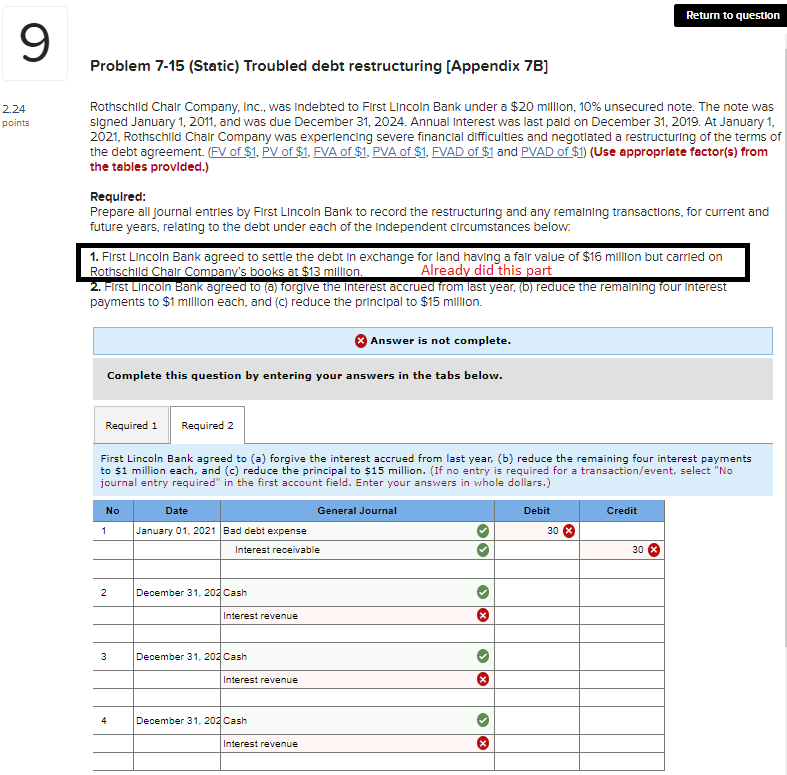

Return to question 9 Problem 7-15 (Static) Troubled debt restructuring (Appendix 7B] 2.24 points Rothschild Chair Company, Inc., was Indebted to First Lincoln Bank under a $20 million, 10% unsecured note. The note was signed January 1, 2011, and was due December 31, 2024. Annual Interest was last paid on December 31, 2019. At January 1, 2021, Rothschild Chair Company was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement. (FV of $1. PV of $1, FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use approprlate factor(s) from the tables provided.) Required: Prepare all journal entries by First Lincoln Bank to record the restructuring and any remaining transactions, for current and future years, relating to the debt under each of the independent circumstances below. 1. First Lincoln Bank agreed to settle the debt in exchange for land having a fair value of $16 million but carried on Rothschild Chair Company's books at $13 million Already did this part 2. First Lincoln Bank agreed to a forgive the interest accrued from last year, (b) reduce the remaining four interest payments to $1 million each, and (c) reduce the principal to $15 million. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 First Lincoln Bank agreed to (a) forgive the interest accrued from last year, (b) reduce the remaining four interest payments to $1 million each, and (c) reduce the principal to $15 million. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) No Debit Credit 1 Date General Journal January 01, 2021 Bad debt expense Interest receivable 30 30 X 2 December 31, 204 Cash > X Interest revenue 3 December 31, 20% Cash Interest revenue 4 December 31, 20% Cash > X Interest revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts