Question: Return to the Sport Hotel example in the course notes, the lesson, and in Chapter 9. Suppose that everything stays the same as was presented

Return to the Sport Hotel example in the course notes, the lesson, and in Chapter 9. Suppose that everything stays the same as was presented in the original problem, except one thing -- the value of the hotel, should the city be awarded the franchise, is not $8 million but instead is $5.95 million. Using this new value of the hotel, what is the NPV of the project assuming that the probability of the city being awarded the franchise is 40%?

Return to the Sport Hotel example in the course notes, the lesson, and in Chapter 9. Suppose that everything stays the same as was presented in the original problem, except one thing -- the value of the hotel, should the city be awarded the franchise, is not $8 million but instead is $5.95 million. Using this new value of the hotel, what is the NPV of the project assuming that the probability of the city being awarded the franchise is 40%?

$ _ million

Place your answer in millions of dollars using three decimal places. For example, the answer of nine hundred and seventy-five thousand would be entered as 0.975

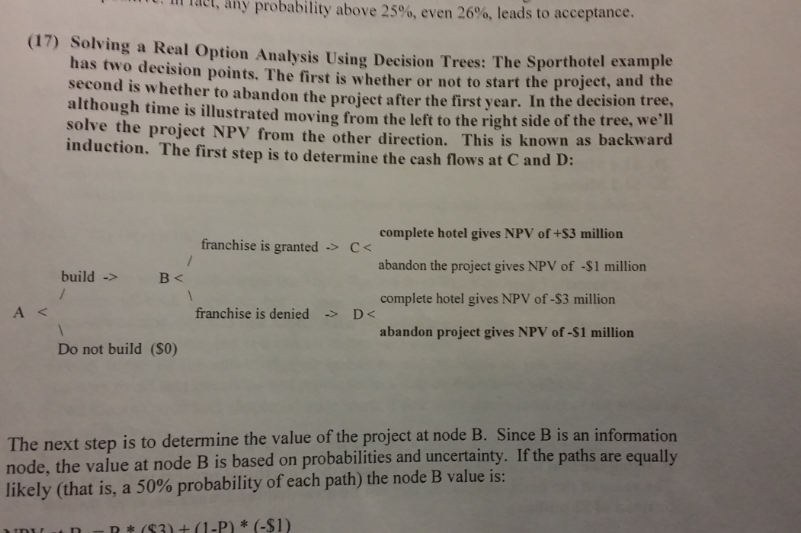

(17) Solving a Real Option Analysis Using Decision Trees: The Sporthotel example has two decision points. The first is whether or not to start the project, and the second is whether to abandon the project after the first year. In the decision tree, although time is illustrated moving from the left to the right side of the tree, we'll solve the project NPV from the other direction. This is known as backward induction. The first step is to determine the cash flows at C and D : The next step is to determine the value of the project at node B. Since B is an information node, the value at node B is based on probabilities and uncertainty. If the paths are equally likely (that is, a 50% probability of each path) the node B value is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts