Question: Returning to the Simplico gold mine example, we saw in the Introduction to Real Options lecture notes that the value of the lease (without the

Returning to the Simplico gold mine example, we saw in the Introduction to Real Options lecture notes that the value of the lease (without the enhancement option) was $24.1m. Without building a lattice, how could you quickly verify that this price was (approximately) correct? Or to put it another way, can you find a quick way to estimate the price of the lease without building a lattice and using backwards evaluation? Hints: Let St denote the price of gold at time t. How much is a security worth St at time t worth today at time 0? Recall also the annuity formula from Section 2.2 of the Interest Rates and Deterministic Cash-Flows notes for computing the value of a constant cash-flow over a fixed number of time periods.

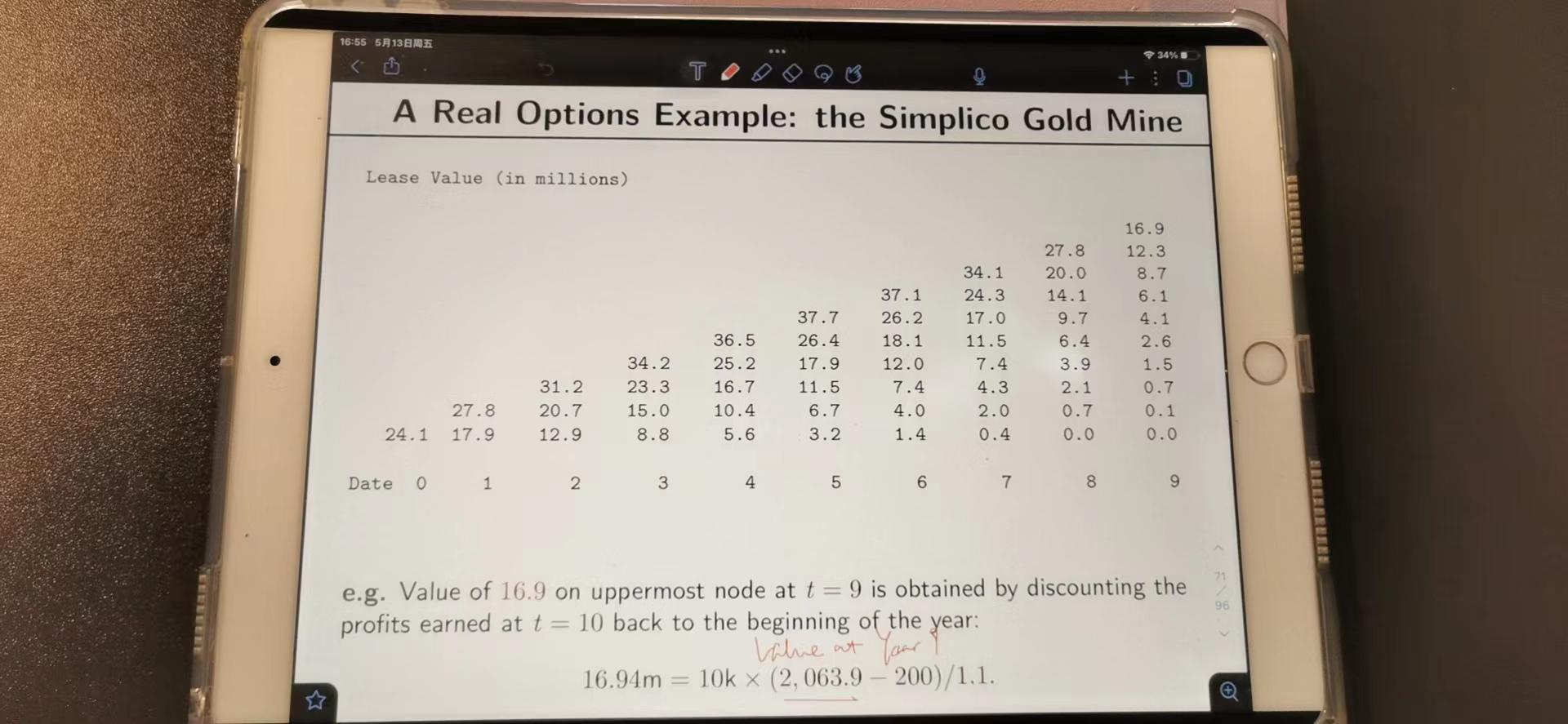

current market price of gold is $400, and it follows a binomial model that it increase each year by a factor of 1.2 with probability of 0.75 or it decreases by a factor of 0.9 with probability 0.25. Interest rates are flat at r=10% per year. Gold can be extracted from the Simplico gold mine at a rate of up to 10000 ounces per year at a cost of C=$200 per ounce.

16:55 513B 34% + : 0 TX A Real Options Example: the Simplico Gold Mine Lease Value (in millions) 37.7 26.4 17.9 11.5 6.7 3.2 36.5 25.2 16.7 10.4 34.1 24.3 17.0 11.5 7.4 4.3 2.0 0.4 37.1 26.2 18.1 12.0 7.4 4.0 1.4. 16.9 12.3 8.7 6.1 4.1 2.6 1.5 0.7 0.1 0.0 27.8 20.0 14.1 9.7 6.4 3.9 2.1 0.7 0.0 34.2 23.3 15.0 31.2 20.7 12.9 27.8 17.9 24.1 8.8 5.6 Date o 1 2 3 4 5 6 7 8 9 EUR 71 98 e.g. Value of 16.9 on uppermost node at t = 9 is obtained by discounting the profits earned at t 10 back to the beginning of the year: Lalue at 16.94m 10k X (2,063.9 200)/1.1. 16:55 513B 34% + : 0 TX A Real Options Example: the Simplico Gold Mine Lease Value (in millions) 37.7 26.4 17.9 11.5 6.7 3.2 36.5 25.2 16.7 10.4 34.1 24.3 17.0 11.5 7.4 4.3 2.0 0.4 37.1 26.2 18.1 12.0 7.4 4.0 1.4. 16.9 12.3 8.7 6.1 4.1 2.6 1.5 0.7 0.1 0.0 27.8 20.0 14.1 9.7 6.4 3.9 2.1 0.7 0.0 34.2 23.3 15.0 31.2 20.7 12.9 27.8 17.9 24.1 8.8 5.6 Date o 1 2 3 4 5 6 7 8 9 EUR 71 98 e.g. Value of 16.9 on uppermost node at t = 9 is obtained by discounting the profits earned at t 10 back to the beginning of the year: Lalue at 16.94m 10k X (2,063.9 200)/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts