Revenue and expense data for Young Technologies Inc. are as follows: Sales Cost of goods sold...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

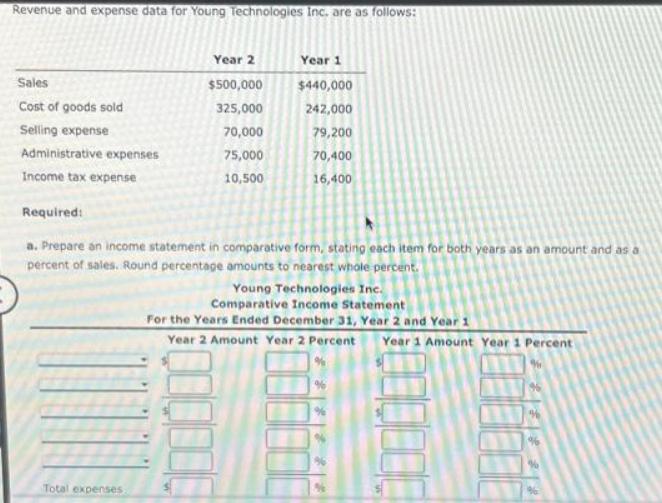

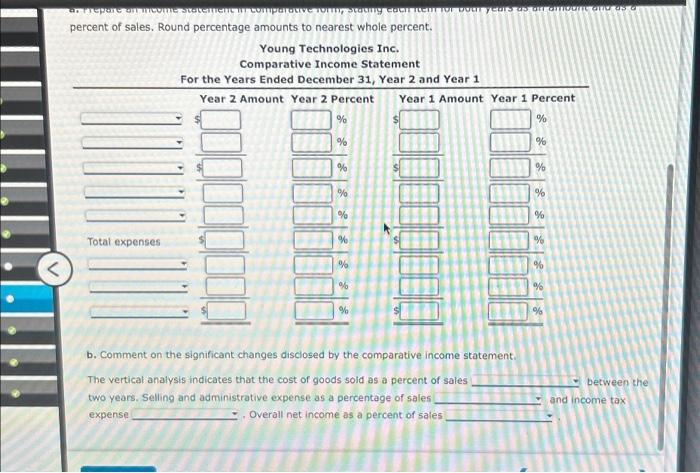

Revenue and expense data for Young Technologies Inc. are as follows: Sales Cost of goods sold Selling expense Administrative expenses Income tax expense Year 2 $500,000 325,000 70,000 Total expenses 75,000 10,500 Year 1 $440,000 242,000 79,200 70,400 16,400 Required: a. Prepare an income statement in comparative form, stating each item for both years as an amount and as a percent of sales. Round percentage amounts to nearest whole percent. Young Technologies Inc. Comparative Income Statement For the Years Ended December 31, Year 2 and Year 1 Year 2 Amount Year 2 Percent Year 1 Amount Year 1 Percent 36 d. Prepare an income Statement i Comparative form, Staung cach nemt for bour years as air amount and as percent of sales. Round percentage amounts to nearest whole percent. Total expenses Young Technologies Inc. Comparative Income Statement For the Years Ended December 31, Year 2 and Year 1 Year 2 Amount Year 2 Percent Year 1 Amount Year 1 Percent % % % % % % % % % % % % b. Comment on the significant changes disclosed by the comparative income statement. The vertical analysis indicates that the cost of goods sold as a percent of sales two years. Selling and administrative expense as a percentage of sales expense . Overall net income as a percent of sales % % 1011 % between the and income tax Revenue and expense data for Young Technologies Inc. are as follows: Sales Cost of goods sold Selling expense Administrative expenses Income tax expense Year 2 $500,000 325,000 70,000 Total expenses 75,000 10,500 Year 1 $440,000 242,000 79,200 70,400 16,400 Required: a. Prepare an income statement in comparative form, stating each item for both years as an amount and as a percent of sales. Round percentage amounts to nearest whole percent. Young Technologies Inc. Comparative Income Statement For the Years Ended December 31, Year 2 and Year 1 Year 2 Amount Year 2 Percent Year 1 Amount Year 1 Percent 36 d. Prepare an income Statement i Comparative form, Staung cach nemt for bour years as air amount and as percent of sales. Round percentage amounts to nearest whole percent. Total expenses Young Technologies Inc. Comparative Income Statement For the Years Ended December 31, Year 2 and Year 1 Year 2 Amount Year 2 Percent Year 1 Amount Year 1 Percent % % % % % % % % % % % % b. Comment on the significant changes disclosed by the comparative income statement. The vertical analysis indicates that the cost of goods sold as a percent of sales two years. Selling and administrative expense as a percentage of sales expense . Overall net income as a percent of sales % % 1011 % between the and income tax

Expert Answer:

Answer rating: 100% (QA)

a Comparative Income Statement Year 2 Year 1 Sales 500000 440000 Cost of Goods Sold 325000 242000 Gr... View the full answer

Related Book For

Financial Reporting Financial Statement Analysis and Valuation

ISBN: 978-0324302950

6th edition

Authors: Clyde P. Stickney

Posted Date:

Students also viewed these accounting questions

-

The Gregoire Company has a maximum production capacity of 35,000 units per year. For that capacity level, fixed costs are $340,000 per year. Variable costs per unit are $65. In the coming year, the...

-

Whichdatabase is/are typically used in the database redesign process? give reason

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

Write a program, in Java, to convert from binary to decimal andfrom from binary to hexadecimal. Please use instance variables,preferably strings. The program must do the conversion withoutusing any...

-

While grading a final exam, an economics professor discovers that two students have virtually identical answers. She is convinced the two cheated but cannot prove it. The professor speaks with each...

-

ReportForthisreason,youhavebeenrequestedtowriteareportdetailingyoursolution'sdesignprocess.Networkdesignsolutionreport: Thereportmustfocusonthenetworkdesignsolution.(1mark)...

-

Do blondes raise more funds? During fundraising, does the physical appearance of the solicitor affect the level of capital raised? An economist at the University of Nevada Reno designed an experiment...

-

Differentiate between a free trade area and a common market. Explain the marketing implications of the differences.

-

Rey Company's single product sells at a price of $231 per unit. Data for its single product for its first year of operations follow. $ 35 per unit 43 per unit Direct materials Direct labor Overhead...

-

In our society it is generally considered improper for a man to sleep, shower, and dress amid a group of women to whom he normally would be sexually attracted. It seems to me, then, to be equally...

-

A duopoly faces a market demand of p = 150 - Q. Firm 1 has a constant marginal cost of MC1 = $10. Firm 2's constant marginal cost is MC2 = $20. Calculate the output of each rm, market output, and...

-

REQUIRED: Cost of production report under the following assumptions: Lost units - normal, discovered at the beginning Lost units - normal, discovered at the end Lost units - abnormal, discovered when...

-

ABC, Inc., manufactures only two products: Gadget A and Gadget B. The firm uses a single, plant wide overhead rate based on direct-labor hours. Production and product-costing data are as follows:...

-

.Jean Saburit has gone over the financial statements for Saburit Parts, Inc. The income statement has been prepared on an absorption costing basis and Saburit would like to have the statement revised...

-

When a constant force is applied to an object, the acceleration of the object varies inversely with its mass. When a certain constant force acts upon an object with mass 2 kg, the acceleration of the...

-

Use the following for all 3 circuits. V1 = 9.0 V, V = 12.0 V R = 2.0 ohms, R = 4.0 ohms, R3 = 6.0 ohms, R4 = 8.0 ohms C1 = 3.0 C = 3.0 (a) Find I in circuit A (b) Find I1 in circuit B R w R3 V R R4...

-

a and b already done just need c-1 c-2 and c-3 thanks! Suppose the yield on short-term government securities (perceived to be risk-free) is about 4%. Suppose also that the expected return required by...

-

Use integration by parts to evaluate the following. Check your answer by taking the derivative. x2e-xdx

-

Problem 10.16 projects financial statements for Wal-Mart Stores for Years +1 through +5. The data in Exhibits 12.16, 12.17, and 12.18 in Chapter 12 include the actual amounts for Year 4 and the...

-

U.S. requirement of reporting comprehensive income does not exist in the United Kingdom, as the WPP Group does not report comprehensive income anywhere in these statements. However, WPP Group does...

-

Empirical research cited in the text indicates that firms with an operating cash flow to current liabilities ratio exceeding 40 percent portray low short-term liquidity risk. Similarly, firms with an...

-

Where is accumulated depreciation reported on the balance sheet? AppendixLO1

-

What was Tootsie Roll's largest current asset at December 31, 2001? The answer to this question is provided on page101. AppendixLO1

-

What is the primary determining factor to distinguish current assets from long-term assets? AppendixLO1

Study smarter with the SolutionInn App