Question: revenue portion Required information Known (determinable) current liabilities are set by agreements or laws and are measurable with little uncertainty. They include accounts payable, sales

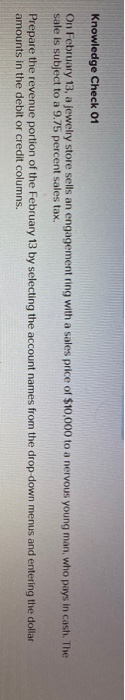

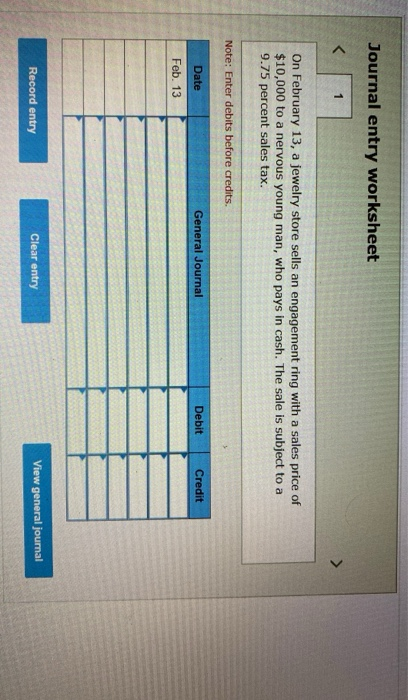

Required information Known (determinable) current liabilities are set by agreements or laws and are measurable with little uncertainty. They include accounts payable, sales taxes payable, unearned revenues, notes payable, payroll liabilities, and the current portion of long-term debt. Knowledge Check 01 On February 13, a jewelry store sells an engagement ring with a sales price of $10,000 to a nervous young man, who pays in cash. The sale is subject to a 9.75 percent sales tax. Prepare the revenue portion of the February 13 by selecting the account names from the drop down menus and entering the dollar amounts in the debit or credit columns. Journal entry worksheet On February 13, a jewelry store sells an engagement ring with a sales price of $10,000 to a nervous young man, who pays in cash. The sale is subject to a 9.75 percent sales tax. Note: Enter debits before credits. Date General Journal Debit Credit Feb. 13 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts