Question: Review the case study below and answer the question that follows. Frannie's Food Emporium sells both taxable (Ontario HST at 13%) and nontaxable items.

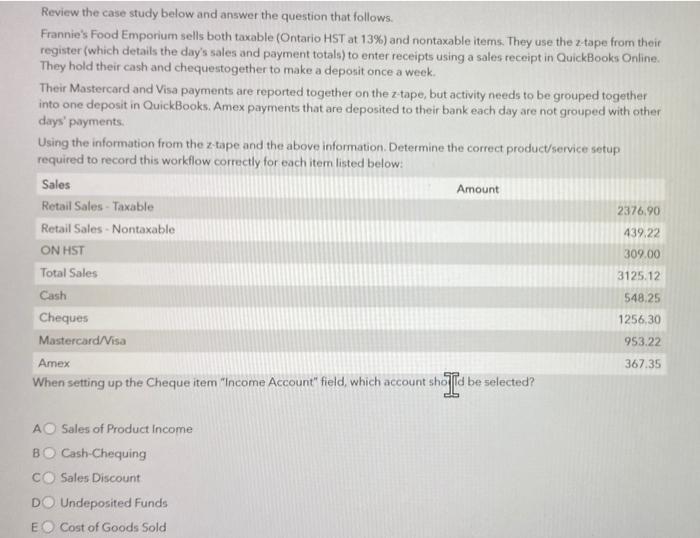

Review the case study below and answer the question that follows. Frannie's Food Emporium sells both taxable (Ontario HST at 13%) and nontaxable items. They use the z-tape from their register (which details the day's sales and payment totals) to enter receipts using a sales receipt in QuickBooks Online. They hold their cash and chequestogether to make a deposit once a week. Their Mastercard and Visa payments are reported together on the z-tape, but activity needs to be grouped together into one deposit in QuickBooks. Amex payments that are deposited to their bank each day are not grouped with other days' payments. Using the information from the z-tape and the above information. Determine the correct product/service setup required to record this workflow correctly for each itern listed below: Sales Retail Sales - Taxable Retail Sales-Nontaxable ON HST Total Sales Cash Cheques Mastercard/Visa Amex When setting up the Cheque item "Income Account" field, which account should be selected? AO Sales of Product Income BO Cash-Chequing CO Sales Discount Amount DO Undeposited Funds EO Cost of Goods Sold 2376.90 439.22 309.00 3125.12 548.25 1256.30 953.22 367.35

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Answer is as follow Answer Answer is Option D Explanation is ... View full answer

Get step-by-step solutions from verified subject matter experts