Question: Review the current liability balances and explain how accounts payable, prepaid expenses and accrued liabilities have affected the cash balance for the current fiscal year.

Review the current liability balances and explain how accounts payable, prepaid expenses and accrued liabilities have affected the cash balance for the current fiscal year.

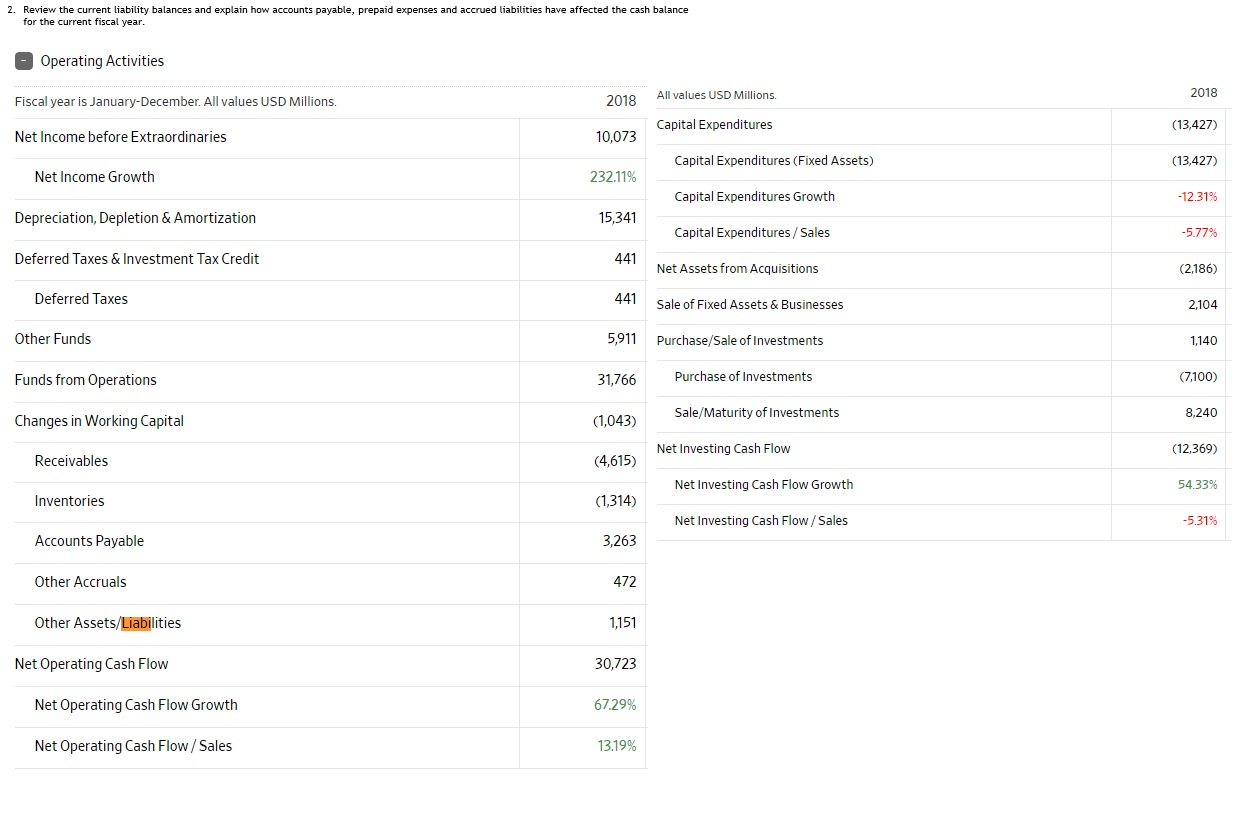

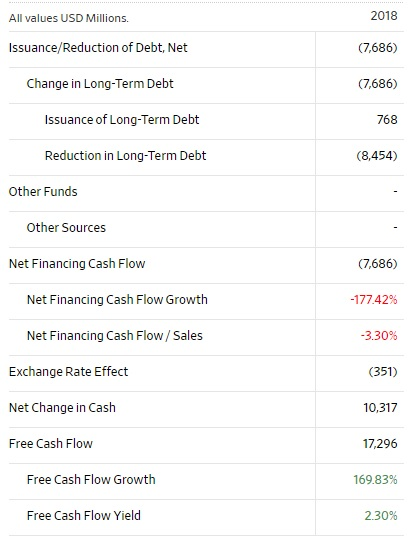

2. Review the current liability balances and explain how accounts payable, prepaid expenses and accrued liabilities have affected the cash balance for the current fiscal year. Operating Activities Fiscal year is January-December. All values USD Millions 2018 2018 All values USD Millions Capital Expenditures (13,427) Net Income before Extraordinaries 10,073 Capital Expenditures (Fixed Assets) (13,427) Net Income Growth 232.11% Capital Expenditures Growth -12.31% Depreciation, Depletion & Amortization 15,341 Capital Expenditures / Sales -5.77% Deferred Taxes & Investment Tax Credit 441 Net Assets from Acquisitions (2,186) Deferred Taxes 441 Sale of Fixed Assets & Businesses 2,104 Other Funds 5,911 Purchase/Sale of Investments 1,140 Funds from Operations 31,766 Purchase of Investments (7,100) Changes in Working Capital (1,043) Sale/Maturity of Investments 8,240 Net Investing Cash Flow (12,369) Receivables (4,615) Net Investing Cash Flow Growth 54.33% Inventories (1,314) Net Investing Cash Flow / Sales -5.31% Accounts Payable 3,263 Other Accruals 472 Other Assets/Liabilities 1,151 Net Operating Cash Flow 30,723 Net Operating Cash Flow Growth 67.29% Net Operating Cash Flow/ Sales 13.19% All values USD Millions. 2018 Issuance/Reduction of Debt, Net (7,686) Change in Long-Term Debt (7,686) Issuance of Long-Term Debt 768 Reduction in Long-Term Debt (8,454) Other Funds Other Sources Net Financing Cash Flow (7,686) Net Financing Cash Flow Growth -177.42% Net Financing Cash Flow / Sales -3.30% Exchange Rate Effect (351) Net Change in Cash 10,317 Free Cash Flow 17,296 Free Cash Flow Growth 169.83% Free Cash Flow Yield 2.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts