Question: Review the portfolio allocation model in this chapter. Identify the decision variables, objective function, and constraints in simple verbal statements, and mathematically formulate the linear

Review the portfolio allocation model in this chapter. Identify the decision variables, objective function, and constraints in simple verbal statements, and mathematically formulate the linear optimization model.

Evans, James R.. Business Analytics (p. 510). Pearson Education. Kindle Edition.

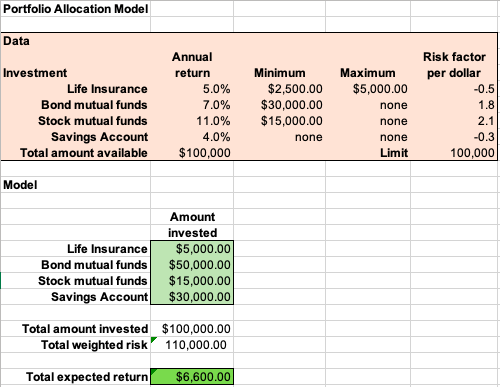

Portfolio Allocation Model Data Risk factor per dollar -0.5 Annual return 5.0% 7.0% 11.0% 4.0% $100,000 Investment Life Insurance Bond mutual funds Stock mutual funds Savings Account Total amount available Minimum $2,500.00 $30,000.00 $15,000.00 none 1.81 Maximum $5,000.00 none none none Limit 2.11 -0.31 100.000 Model Life Insurance Bond mutual funds Stock mutual funds Savings Account Amount invested $5,000.00 $50,000.00 $15,000.00 $30,000.00 Total amount invested Total weighted risk $100,000.00 110,000.00 Total expected return $6,600.00 Portfolio Allocation Model Data Risk factor per dollar -0.5 Annual return 5.0% 7.0% 11.0% 4.0% $100,000 Investment Life Insurance Bond mutual funds Stock mutual funds Savings Account Total amount available Minimum $2,500.00 $30,000.00 $15,000.00 none 1.81 Maximum $5,000.00 none none none Limit 2.11 -0.31 100.000 Model Life Insurance Bond mutual funds Stock mutual funds Savings Account Amount invested $5,000.00 $50,000.00 $15,000.00 $30,000.00 Total amount invested Total weighted risk $100,000.00 110,000.00 Total expected return $6,600.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts