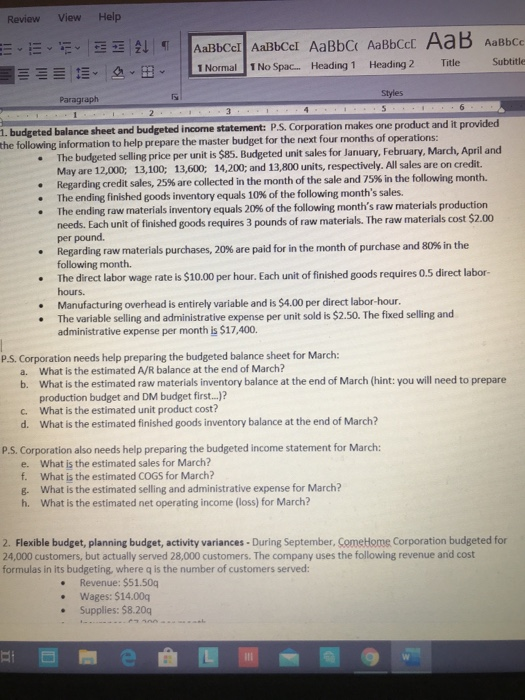

Question: Review View Help EEEEE AaBb el AaBbcc AaBb AaBbcc AaB AaBbc 1 Normal No Spac... Heading 1 Heading 2 Title Subtit Paragraph Styles 1. budgeted

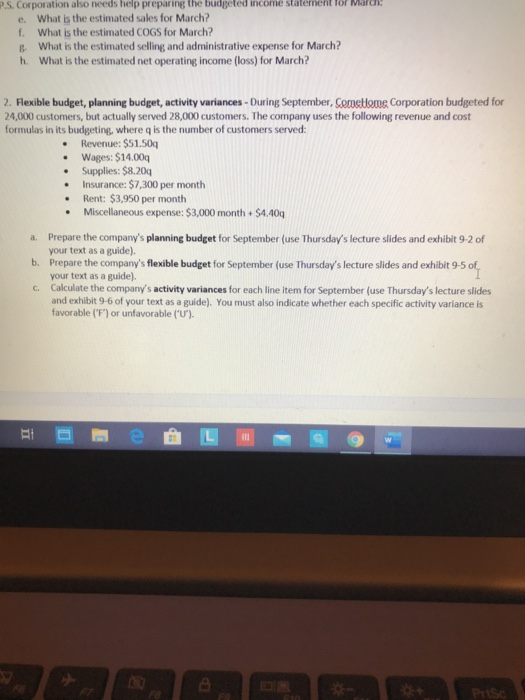

Review View Help EEEEE AaBb el AaBbcc AaBb AaBbcc AaB AaBbc 1 Normal No Spac... Heading 1 Heading 2 Title Subtit Paragraph Styles 1. budgeted balance sheet and budgeted income statement: P.S. Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations: The budgeted selling price per unit is $85. Budgeted unit sales for January February March April and May are 12,000; 13,100; 13,600; 14,200; and 13,800 units, respectively. All sales are on credit. Regarding credit sales, 25% are collected in the month of the sale and 75% in the following month The ending finished goods inventory equals 10% of the following month's sales. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 3 pounds of raw materials. The raw materials cost $2.00 per pound. Regarding raw materials purchases, 20% are paid for in the month of purchase and 80% in the following month. The direct labor wage rate is $10.00 per hour. Each unit of finished goods requires 0.5 direct labor hours. Manufacturing overhead is entirely variable and is $4.00 per direct labor-hour. The variable selling and administrative expense per unit sold is $2.50. The fixed selling and administrative expense per month is $17.400. P.S. Corporation needs help preparing the budgeted balance sheet for March: a. What is the estimated A/R balance at the end of March? b. What is the estimated raw materials inventory balance at the end of March (hint: you will need to prepare production budget and DM budget first...)? C. What is the estimated unit product cost? d. What is the estimated finished goods inventory balance at the end of March? P.S. Corporation also needs help preparing the budgeted income statement for March: e. What is the estimated sales for March? f. What is the estimated COGS for March? 8. What is the estimated selling and administrative expense for March? h. What is the estimated net operating income (loss) for March? 2. Flexible budget, planning budget, activity variances. During September. Come Home Corporation budgeted for 24,000 customers, but actually served 28.000 customers. The company uses the following revenue and cost formulas in its budgeting, where is the number of customers served: Revenue: $51.500 Wages: $14.00 Supplies: 58.209 1. budgeted balance sheet and budgeted income statement: P.S. Corporation makes one product and it provided the following information to help prepare the master budget for the next four months of operations: The budgeted selling price per unit is $85. Budgeted unit sales for January, February March April and May are 12,000; 13,100, 13,600; 14,200; and 13,800 units, respectively. All sales are on credit. Regarding credit sales, 25% are collected in the month of the sale and 75% in the following month. The ending finished goods inventory equals 10% of the following month's sales. The ending raw materials inventory equals 20% of the following month's raw materials production needs. Each unit of finished goods requires 3 pounds of raw materials. The raw materials cost $2.00 per pound. Regarding raw materials purchases, 20% are paid for in the month of purchase and 80% in the following month. The direct labor wage rate is $10.00 per hour. Each unit of finished goods requires 0.5 direct labor- hours. Manufacturing overhead is entirely variable and is $4.00 per direct labor-hour. The variable selling and administrative expense per unit sold is $2.50. The fixed selling and administrative expense per month is $17,400. P.S. Corporation needs help preparing the budgeted balance sheet for March: a. What is the estimated A/R balance at the end of March? b. What is the estimated raw materials inventory balance at the end of March (hint: you will need to prepare production budget and DM budget first...)? C. What is the estimated unit product cost? d. What is the estimated finished goods inventory balance at the end of March? P.S. Corporation also needs help preparing the budgeted income statement for March: e. What is the estimated sales for March? f. What is the estimated COGS for March? B: What is the estimated selling and administrative expense for March? h. What is the estimated net operating income (loss) for March? 2. Flexible budget, planning budget, activity variances - During September, ComeHome Corporation budgeted for 24,000 customers, but actually served 28,000 customers. The company uses the following revenue and cost formulas in its budgeting, where is the number of customers served: Revenue: $51.50g Wages: $14.000 Supplies: $8.200 Insurance: $7,300 per month Rent: $3,950 per month Miscellaneous expense: $3,000 month + $4.40 a. Prepare the company's planning budget for September (use Thursday's lecture slides and exhibit 9-2 of your text as a guide). b. Prepare the company's flexible budget for September (use Thursday's lecture slides and exhibit 9-5 of your text as a guide). C Calculate the company's activity variances for each line item for September (use Thursday's lecture slides and exhibit 9-6 of your text as a guide). You must also indicate whether each specific activity variance is favorable ('F') or unfavorable ('U')

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts