Question: Revision Question. please answer a) b) c) GrandInteriors Ltd is a Mauritian company which specializes in the manufacturing of frameless glass doors. The company is

Revision Question. please answer a) b) c)

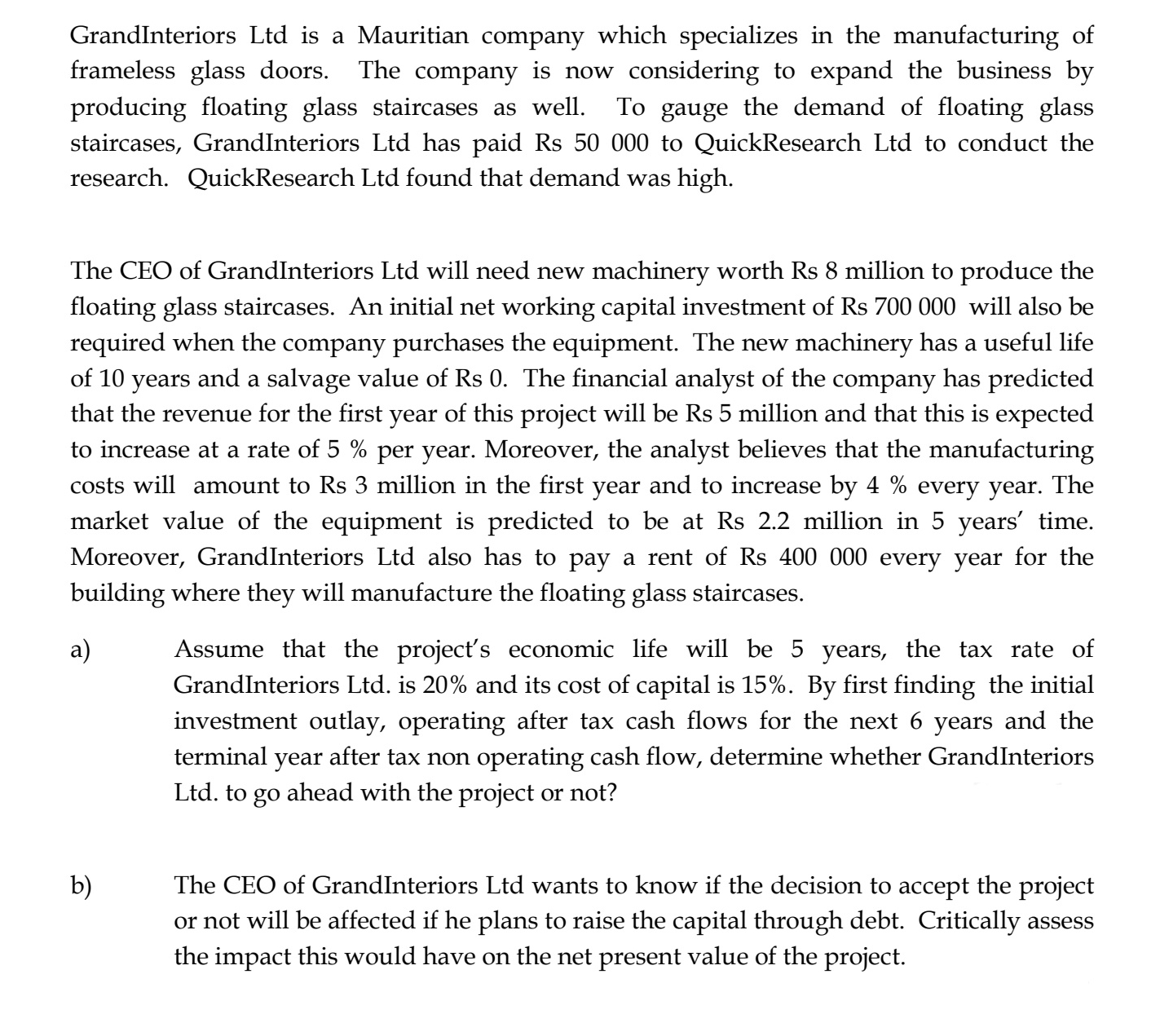

GrandInteriors Ltd is a Mauritian company which specializes in the manufacturing of frameless glass doors. The company is now considering to expand the business by producing oating glass staircases as well. To gauge the demand of oating glass staircases, GrandInteriors Ltd has paid Rs 50 000 to QuickResearch Ltd to conduct the research. QuickResearch Ltd found that demand was high. The CEO of GrandInteriors Ltd will need new machinery worth Rs 8 million to produce the oating glass staircases. An initial net working capital investment of Rs 700 000 will also be required when the company purchases the equipment. The new machinery has a useful life of 10 years and a salvage value of Rs 0. The financial analyst of the company has predicted that the revenue for the first year of this project will be Rs 5 million and that this is expected to increase at a rate of 5 % per year. Moreover, the analyst believes that the manufacturing costs will amount to Rs 3 million in the first year and to increase by 4 % every year. The market value of the equipment is predicted to be at Rs 2.2 million in 5 years' time. Moreover, GrandInteriors Ltd also has to pay a rent of Rs 400 000 every year for the building where they will manufacture the oating glass staircases. a) Assume that the project's economic life will be 5 years, the tax rate of GrandInteriors Ltd. is 20% and its cost of capital is 15%. By first finding the initial investment outlay, operating after tax cash ows for the next 6 years and the terminal year after tax non operating cash ow, determine whether GrandInteriors Ltd. to go ahead with the project or not? b) The CEO of GrandInteriors Ltd wants to know if the decision to accept the project or not will be affected if he plans to raise the capital through debt. Critically assess the impact this would have on the net present value of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts