Question: A firm owes $44 million in pure discount debt 6 years from today. The firm's assets have a market value of $21 million and

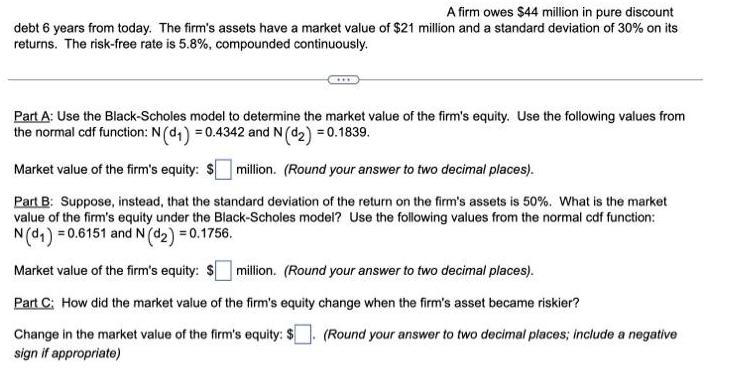

A firm owes $44 million in pure discount debt 6 years from today. The firm's assets have a market value of $21 million and a standard deviation of 30% on its returns. The risk-free rate is 5.8%, compounded continuously. Part A: Use the Black-Scholes model to determine the market value of the firm's equity. Use the following values from the normal cdf function: N (d) = 0.4342 and N (d2) = 0.1839. Market value of the firm's equity: $ million. (Round your answer to two decimal places). Part B: Suppose, instead, that the standard deviation of the return on the firm's assets is 50%. What is the market value of the firm's equity under the Black-Scholes model? Use the following values from the normal cdf function: N (d) = 0.6151 and N (d) = 0.1756. Market value of the firm's equity: $ million. (Round your answer to two decimal places). Part C: How did the market value of the firm's equity change when the firm's asset became riskier? Change in the market value of the firm's equity: sign if appropriate) (Round your answer to two decimal places; include a negative

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Using the formula below we can determine the Market Value of equity E VN d1 Dert Nd2 Where V ... View full answer

Get step-by-step solutions from verified subject matter experts