Question: RIC.com has developed a powerful new server that would be used for corporations Internet activities. It would cost $10 million at Year 0 to buy

| RIC.com has developed a powerful new server that would be used for corporations Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year equal to 10% of sales; NOWC0 = 10%(Sales1), NOWC1 = 10%(Sales2), etc. The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After Year 1, the sales price and variable costs would increase at the inflation rate of 3%. The companys non-variable costs would be $1 million at Year 1, and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the projects returns are expected to be highly correlated with returns on the firms other assets. The firm believes it could sell 1,000 units per year. | ||||||||

| ||||||||

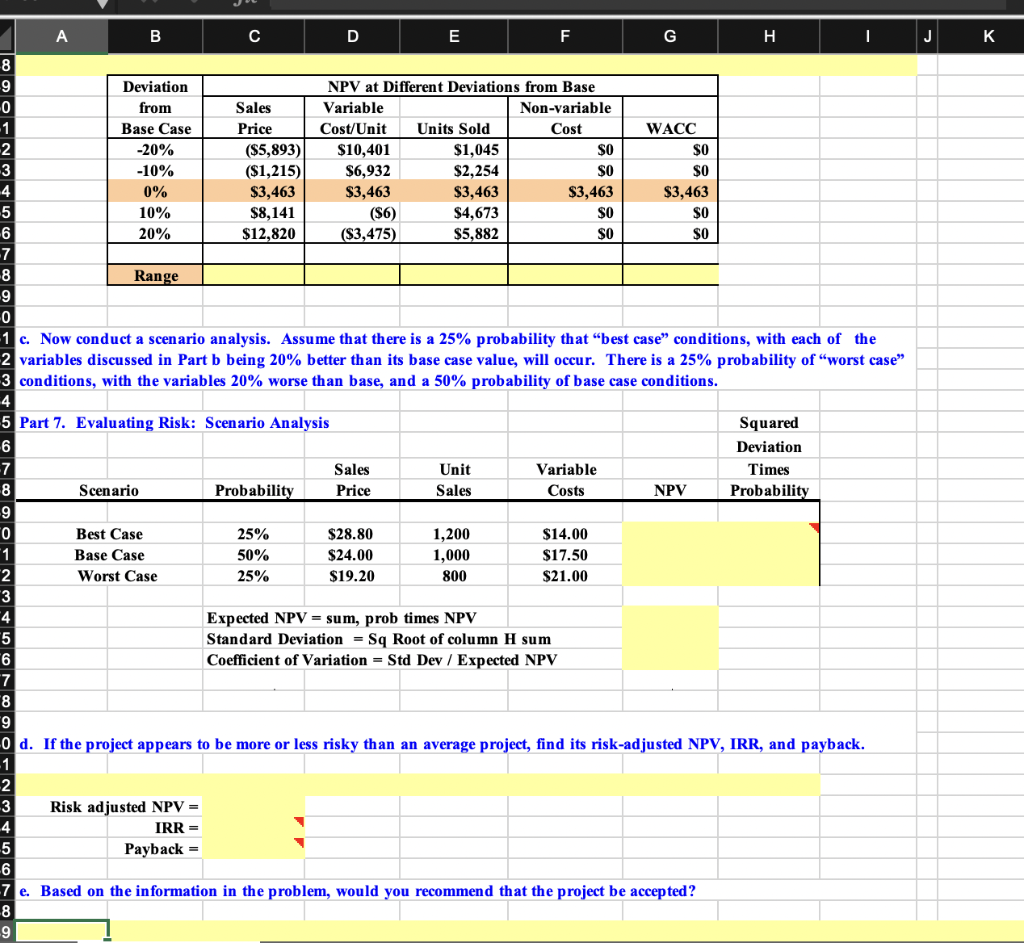

J K Price A B D E G H 8 9 Deviation NPV at Different Deviations from Base -0 from Sales Variable Non-variable -1 Base Case Cost/Unit Units Sold Cost WACC 2 -20% ($5,893) $10,401 $1,045 SO $0 3 -10% ($1,215) $6,932 $2,254 SO $0 4 0% $3,463 $3,463 $3,463 $3,463 $3,463 5 10% $8,141 (56) $4,673 $0 $0 -6 20% $12,820 ($3,475) $5,882 SO $0 7 8 Range 9 0 1 c. Now conduct a scenario analysis. Assume that there is a 25% probability that "best case" conditions, with each of the 2 variables discussed in Part b being 20% better than its base case value, will occur. There is a 25% probability of worst case 3 conditions, with the variables 20% worse than base, and a 50% probability of base case conditions. 4 5 Part 7. Evaluating Risk: Scenario Analysis Squared 6 Deviation -7 Sales Unit Variable Times 8 Scenario Probability Price Sales Costs NPV Probability 9 0 Best Case 25% $28.80 1,200 $14.00 1 Base Case 50% $24.00 1,000 $17.50 2 Worst Case 25% $19.20 800 $21.00 3 4 Expected NPV = sum, prob times NPV 5 Standard Deviation = Sq Root of column H sum "6 Coefficient of Variation = Std Dev / Expected NPV 7 8 "9 0 d. If the project appears to be more or less risky than an average project, find its risk-adjusted NPV, IRR, and payback. 1 2 3 Risk adjusted NPV = 4 IRR - 5 Payback - -6 7 e. Based on the information in the problem, would you recommend that the project be accepted? 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts