Question: RIC.com has developed a powerful new server that would be used for corporations Internet activities. It would cost $10 million at Year 0 to buy

RIC.com has developed a powerful new server that would be used for corporations Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year equal to 10% of sales; NOWC0 = 10%(Sales1), NOWC1 = 10%(Sales2), etc. The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After Year 1, the sales price and variable costs would increase at the inflation rate of 3%. The companys non-variable costs would be $1 million at Year 1, and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the projects returns are expected to be highly correlated with returns on the firms other assets. The firm believes it could sell 1,000 units per year.

The equipment would be depreciated over a 5-year period, using MACRS rates. The estimated market value of the equipment at the end of the projects 4-year life is $500,000. Webmasters federal-plus-state tax rate is 40%. Its cost of capital is 10% for average risk projects, defined as projects with a coefficient of variation for NPV between 0.8 and 1.2. Low risk projects are evaluated with a WACC of 8%, and high risk projects at 13%.

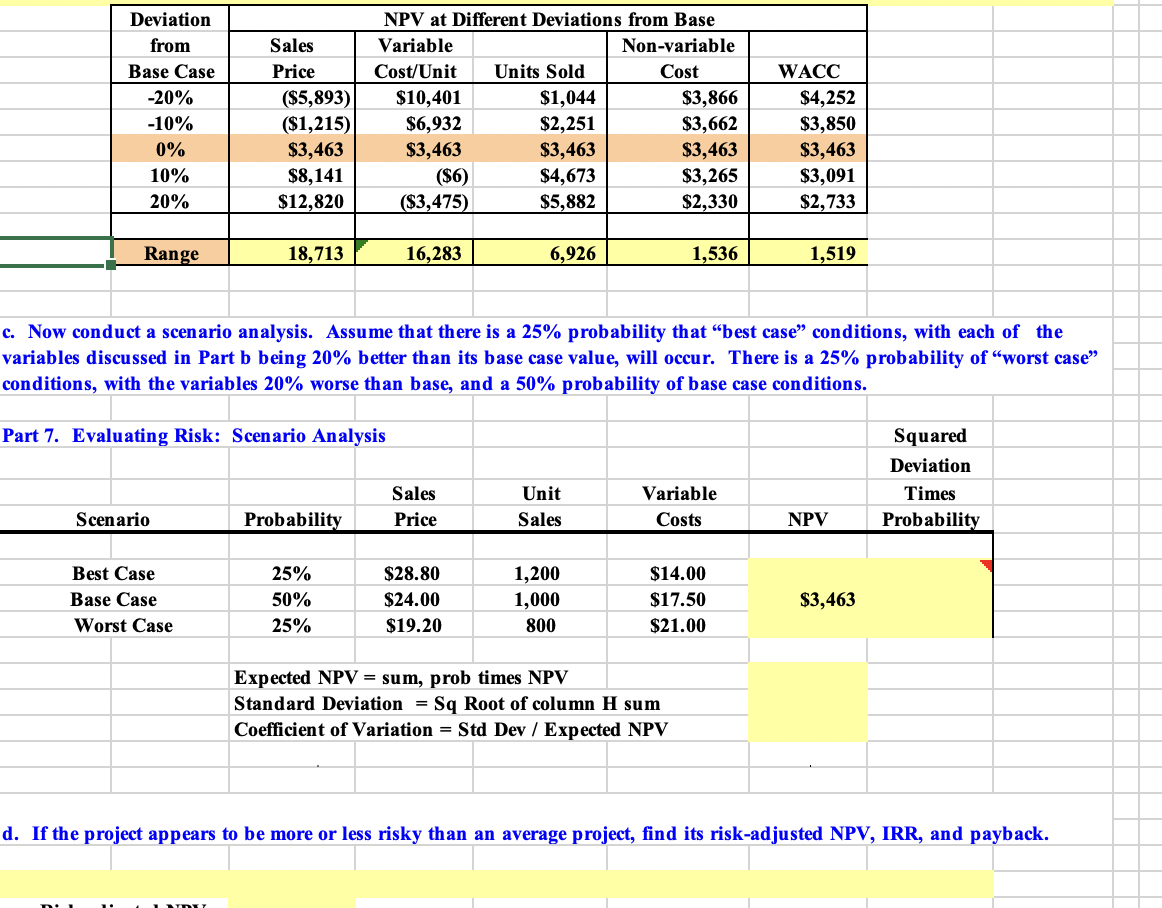

Deviation from Base Case -20% -10% 0% 10% 20% Sales Price ($5,893) ($1,215) $3,463 $8,141 $12,820 NPV at Different Deviations from Base Variable Non-variable Cost/Unit Units Sold Cost $10,401 $1,044 $3,866 $6,932 $2,251 $3,662 $3,463 $3,463 $3,463 ($6) $4,673 $3,265 ($3,475) $5,882 $2,330 WACC $4,252 $3,850 $3,463 $3,091 $2,733 Range 18,713 16,283 6,926 1,536 1,519 c. Now conduct a scenario analysis. Assume that there is a 25% probability that "best case" conditions, with each of the variables discussed in Part b being 20% better than its base case value, will occur. There is a 25% probability of "worst case" conditions, with the variables 20% worse than base, and a 50% probability of base case conditions. Part 7. Evaluating Risk: Scenario Analysis Squared Deviation Times Probability Sales Price Unit Sales Variable Costs Scenario Probability NPV Best Case Base Case Worst Case 25% 50% 25% $28.80 $24.00 $19.20 1,200 1,000 800 $14.00 $17.50 $21.00 $3,463 Expected NPV = sum, prob times NPV Standard Deviation = Sq Root of column H sum Coefficient of Variation = Std Dev / Expected NPV d. If the project appears to be more or less risky than an average project, find its risk-adjusted NPV, IRR, and payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts