Question

Rick, a second-year accounting student has charged various friends and acquaintances a $80 fee to prepare their individual income tax returns. Matt, an accounting graduate,

Rick, a second-year accounting student has charged various friends and acquaintances a $80 fee to prepare their individual income tax returns.

For each of the case indicate whether the individuals concerned have committed an offence. Where an offence has been committed, state the relevant section of the Income Tax Administration Act that they have breached.

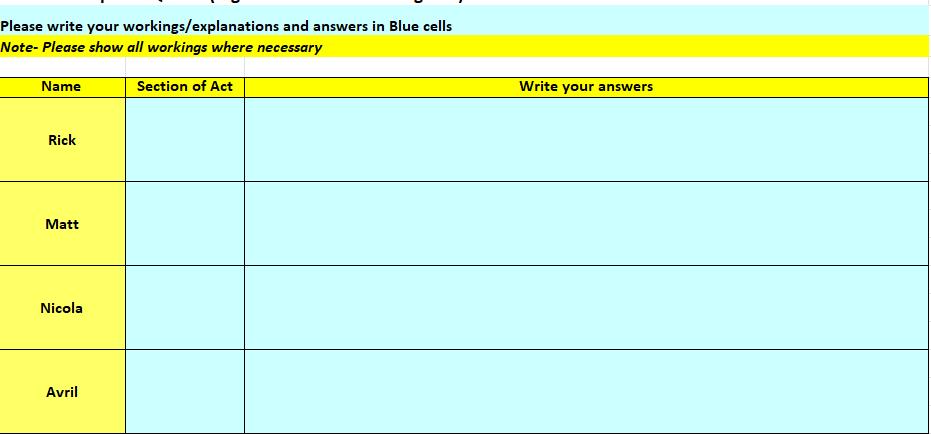

Please write your workings/explanations and answers in Blue cells Note- Please show all workings where necessary Name Rick Matt Nicola Avril Section of Act Write your answers

Step by Step Solution

3.36 Rating (119 Votes )

There are 3 Steps involved in it

Step: 1

Here is a table outlining whether the individuals in question have committed an offense under the Income Tax Administration Act along with the relevan...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started