Question: Risk and Return The information below is used to answer the next three questions. Returns on stock A and stock B over the next year

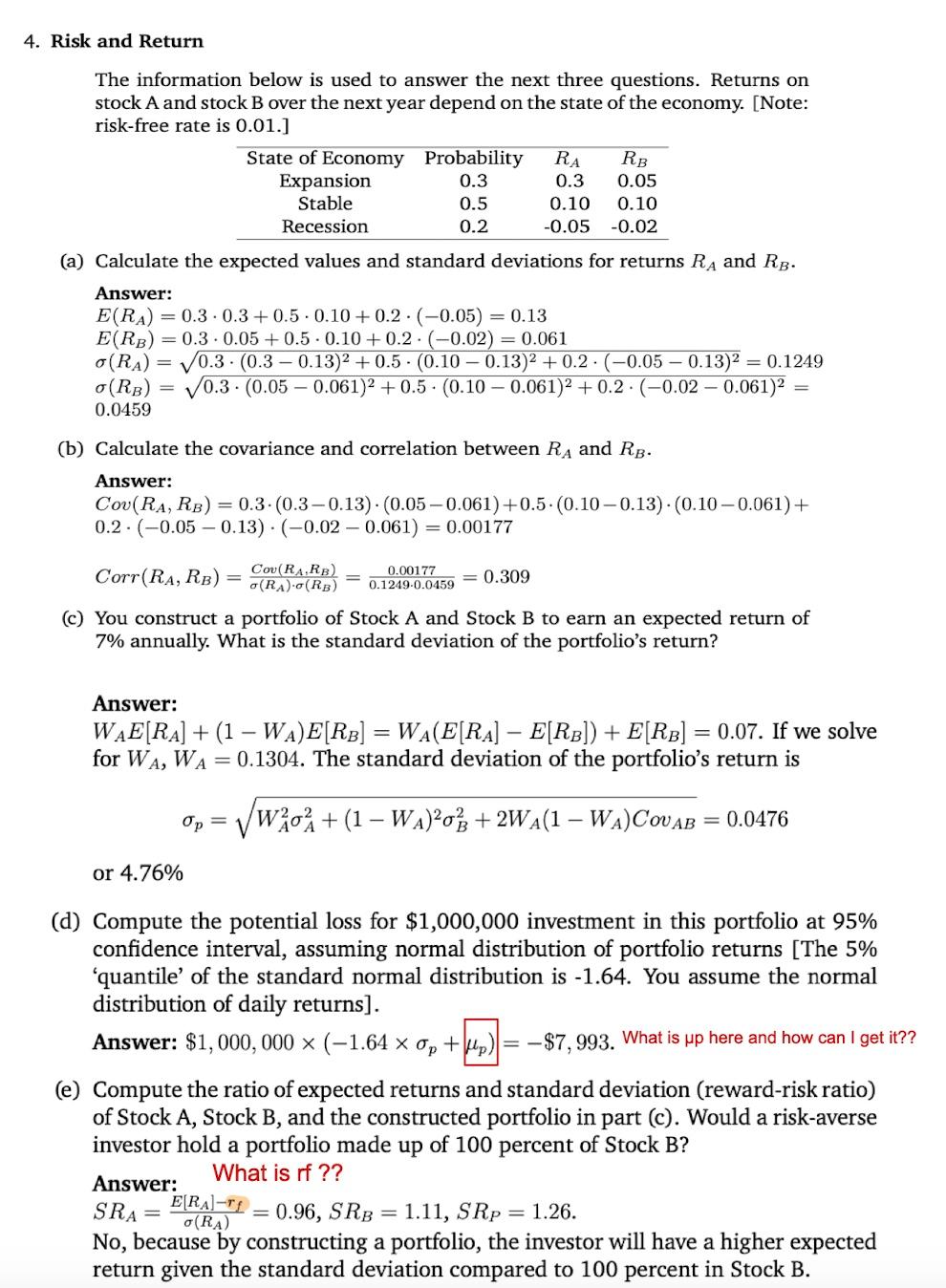

Risk and Return The information below is used to answer the next three questions. Returns on stock A and stock B over the next year depend on the state of the economy. [Note: risk-free rate is 0.01. (a) Calculate the expected values and standard deviations for returns RA and RB. Answer: E(RA)=0.30.3+0.50.10+0.2(0.05)=0.13E(RB)=0.30.05+0.50.10+0.2(0.02)=0.061(RA)=0.3(0.30.13)2+0.5(0.100.13)2+0.2(0.050.13)2=0.1249(RB)=0.3(0.050.061)2+0.5(0.100.061)2+0.2(0.020.061)2=0.0459 (b) Calculate the covariance and correlation between RA and RB. Answer: Cov(RA,RB)=0.3(0.30.13)(0.050.061)+0.5(0.100.13)(0.100.061)+0.2(0.050.13)(0.020.061)=0.00177Corr(RA,RB)=(RA)(RB)Cov(RA,RB)=0.12490.04590.00177=0.309 (c) You construct a portfolio of Stock A and Stock B to earn an expected return of 7% annually. What is the standard deviation of the portfolio's return? Answer: WAE[RA]+(1WA)E[RB]=WA(E[RA]E[RB])+E[RB]=0.07. If we solve for WA,WA=0.1304. The standard deviation of the portfolio's return is p=WA2A2+(1WA)2B2+2WA(1WA)CovAB=0.0476 or 4.76% (d) Compute the potential loss for $1,000,000 investment in this portfolio at 95% confidence interval, assuming normal distribution of portfolio returns [The 5% 'quantile' of the standard normal distribution is -1.64. You assume the normal distribution of daily returns]. Answer: $1,000,000(1.64p+p)=$7,993. What is p here and how can I get it?? (e) Compute the ratio of expected returns and standard deviation (reward-risk ratio) of Stock A, Stock B, and the constructed portfolio in part (c). Would a risk-averse investor hold a portfolio made up of 100 percent of Stock B? Answer: What is if ?? SRA=(RA)E[RA]rf=0.96,SRB=1.11,SRP=1.26. No, because by constructing a portfolio, the investor will have a higher expected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts