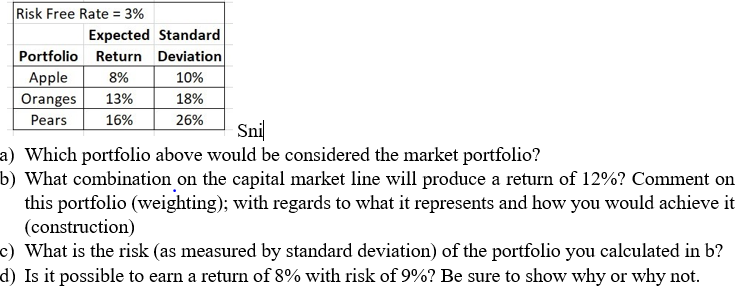

Question: Risk Free Rate = 3% Expected Standard Portfolio Return Deviation Apple 8% 10% Oranges 13% 18% Pears 16% 26% Snil a) Which portfolio above would

Risk Free Rate = 3% Expected Standard Portfolio Return Deviation Apple 8% 10% Oranges 13% 18% Pears 16% 26% Snil a) Which portfolio above would be considered the market portfolio? b) What combination on the capital market line will produce a return of 12%? Comment on this portfolio (weighting); with regards to what it represents and how you would achieve it (construction) c) What is the risk (as measured by standard deviation) of the portfolio you calculated in b? d) Is it possible to earn a return of 8% with risk of 9%? Be sure to show why or why not. Risk Free Rate = 3% Expected Standard Portfolio Return Deviation Apple 8% 10% Oranges 13% 18% Pears 16% 26% Snil a) Which portfolio above would be considered the market portfolio? b) What combination on the capital market line will produce a return of 12%? Comment on this portfolio (weighting); with regards to what it represents and how you would achieve it (construction) c) What is the risk (as measured by standard deviation) of the portfolio you calculated in b? d) Is it possible to earn a return of 8% with risk of 9%? Be sure to show why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts