Question: risk management and insurance Case Study 5 Chapter 8 Pg201 Ken and Kate both are 35 years old and they are currently staying in Taman

risk management and insurance

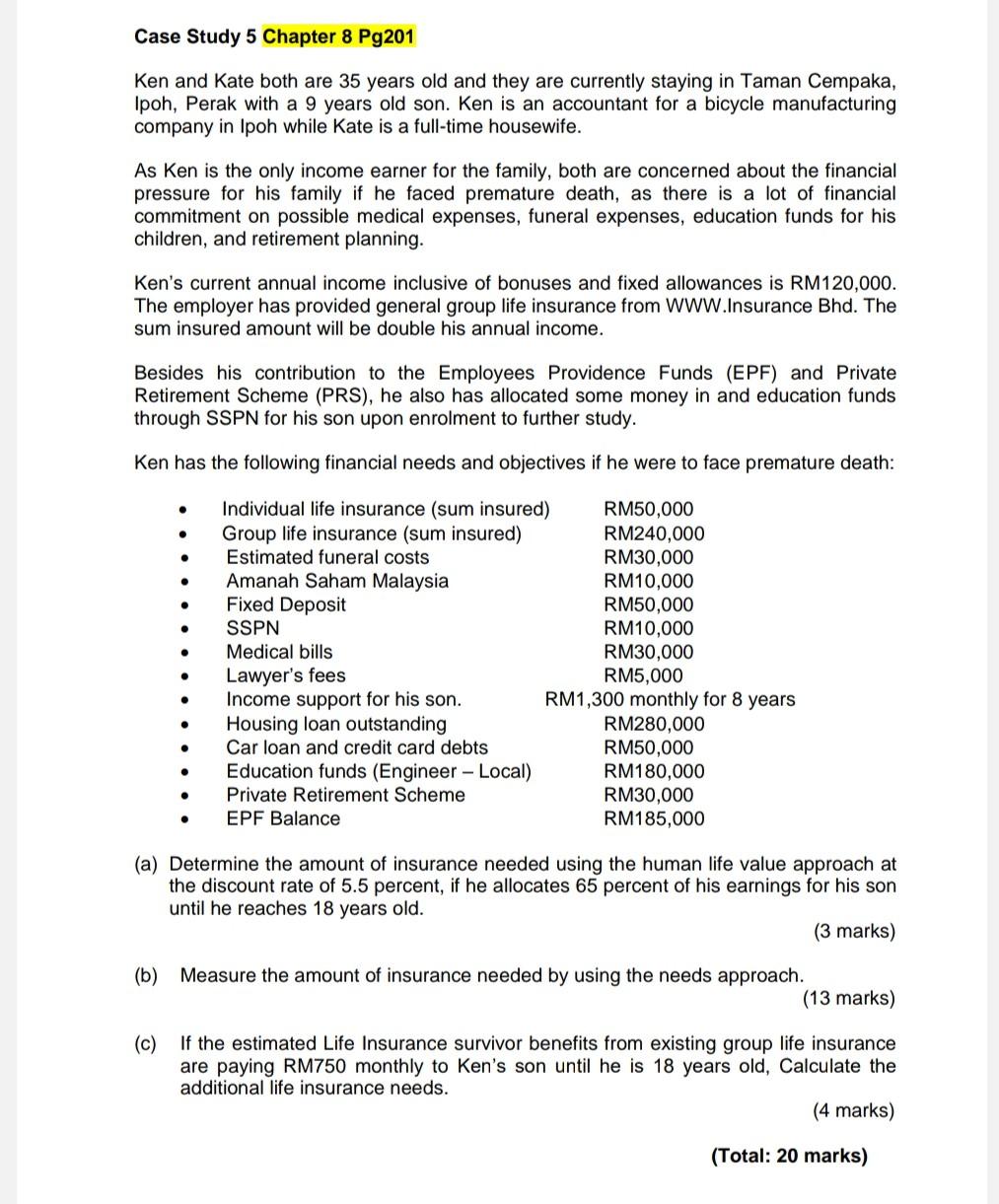

Case Study 5 Chapter 8 Pg201 Ken and Kate both are 35 years old and they are currently staying in Taman Cempaka, Ipoh, Perak with a 9 years old son. Ken is an accountant for a bicycle manufacturing company in Ipoh while Kate is a full-time housewife. As Ken is the only income earner for the family, both are concerned about the financial pressure for his family if he faced premature death, as there is a lot of financial commitment on possible medical expenses, funeral expenses, education funds for his children, and retirement planning. Ken's current annual income inclusive of bonuses and fixed allowances is RM120,000. The employer has provided general group life insurance from WWW.Insurance Bhd. The sum insured amount will be double his annual income. Besides his contribution to the Employees Providence Funds (EPF) and Private Retirement Scheme (PRS), he also has allocated some money in and education funds through SSPN for his son upon enrolment to further study. Ken has the following financial needs and objectives if he were to face premature death: (a) Determine the amount of insurance needed using the human life value approach at the discount rate of 5.5 percent, if he allocates 65 percent of his earnings for his son until he reaches 18 years old. (3 marks) (b) Measure the amount of insurance needed by using the needs approach. (13 marks) (c) If the estimated Life Insurance survivor benefits from existing group life insurance are paying RM750 monthly to Ken's son until he is 18 years old, Calculate the additional life insurance needs. (4 marks) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts