Question: RISK, RETURN AND BOND VALUATION QUESTION Note: Kindly answer in typed words...not in pic a) Mbo Ltd has the following rate of return under different

RISK, RETURN AND BOND VALUATION QUESTION

Note: Kindly answer in typed words...not in pic

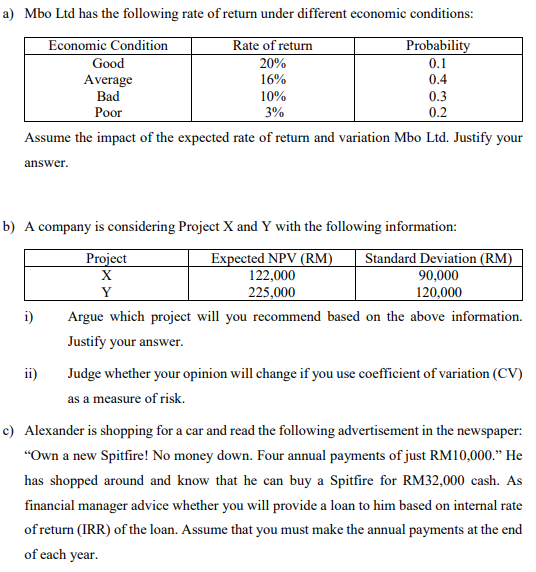

a) Mbo Ltd has the following rate of return under different economic conditions: Economic Condition Rate of return Probability Good 20% 0.1 Average 16% 0.4 Bad 10% 0.3 Poor 3% Assume the impact of the expected rate of return and variation Mbo Ltd. Justify your 0.2 answer. b) A company is considering Project X and Y with the following information: Project Expected NPV (RM) Standard Deviation (RM) X 122,000 90,000 Y 225,000 120,000 i) Argue which project will you recommend based on the above information. Justify your answer. ii) Judge whether your opinion will change if you use coefficient of variation (CV) as a measure of risk. c) Alexander is shopping for a car and read the following advertisement in the newspaper: "Own a new Spitfire! No money down. Four annual payments of just RM10,000. He has shopped around and know that he can buy a Spitfire for RM32,000 cash. As financial manager advice whether you will provide a loan to him based on internal rate of return (IRR) of the loan. Assume that you must make the annual payments at the end of each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts