Question: Country : Malaysia Subject : Financial Management TUTORIAL - RISK, RETURN AND BOND VALUATION QUESTION 1 (P-3) a) Mbo Ltd has the following rate of

Country : Malaysia

Subject : Financial Management

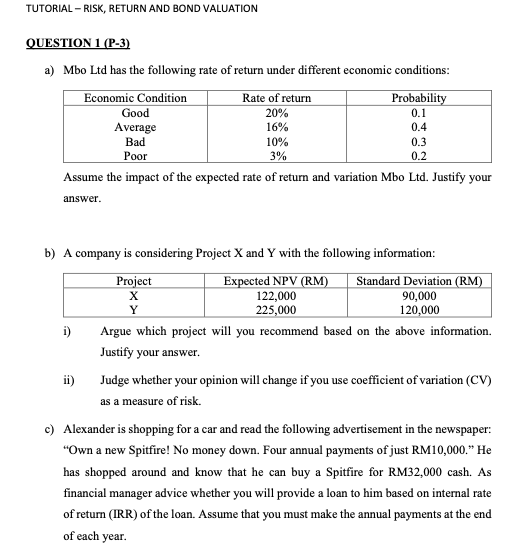

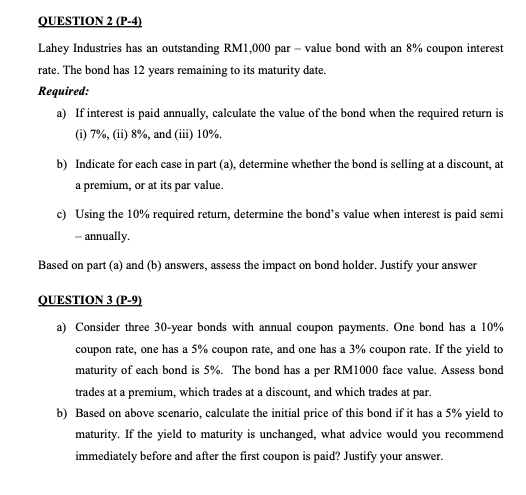

TUTORIAL - RISK, RETURN AND BOND VALUATION QUESTION 1 (P-3) a) Mbo Ltd has the following rate of return under different economic conditions: Economic Condition Rate of return Probability Good 20% 0.1 Average 16% 0.4 Bad 10% 0.3 Poor 3% Assume the impact of the expected rate of return and variation Mbo Ltd. Justify your answer. 0.2 b) A company is considering Project X and Y with the following information: Project Expected NPV (RM) Standard Deviation (RM) 122,000 90,000 Y 225,000 120,000 i) Argue which project will you recommend based on the above information. Justify your answer. ii) Judge whether your opinion will change if you use coefficient of variation (CV) as a measure of risk. c) Alexander is shopping for a car and read the following advertisement in the newspaper: "Own a new Spitfire! No money down. Four annual payments of just RM10,000." He has shopped around and know that he can buy a Spitfire for RM32,000 cash. As financial manager advice whether you will provide a loan to him based on internal rate of return (IRR) of the loan. Assume that you must make the annual payments at the end of each year. QUESTION 2 (P-4) Lahey Industries has an outstanding RM1,000 par - value bond with an 8% coupon interest rate. The bond has 12 years remaining to its maturity date. Required: a) If interest is paid annually, calculate the value of the bond when the required return is 1) 7%, (ii) 8%, and (iii) 10%. b) Indicate for each case in part (a), determine whether the bond is selling at a discount, at a premium, or at its par value. c) Using the 10% required return, determine the bond's value when interest is paid semi - annually. Based on part (a) and (b) answers, assess the impact on bond holder. Justify your answer QUESTION 3 (P-9) a) Consider three 30-year bonds with annual coupon payments. One bond has a 10% coupon rate, one has a 5% coupon rate, and one has a 3% coupon rate. If the yield to maturity of each bond is 5%. The bond has a per RM1000 face value. Assess bond trades at a premium, which trades at a discount, and which trades at par. b) Based on above scenario, calculate the initial price of this bond if it has a 5% yield to maturity. If the yield to maturity is unchanged, what advice would you recommend immediately before and after the first coupon is paid? Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts