Question: RISK, RETURN AND BOND VALUATION QUESTION Note: Kindly answer in typed words... not in excel and handworked a) Consider three 30-year bonds with annual coupon

RISK, RETURN AND BOND VALUATION QUESTION

Note: Kindly answer in typed words... not in excel and handworked

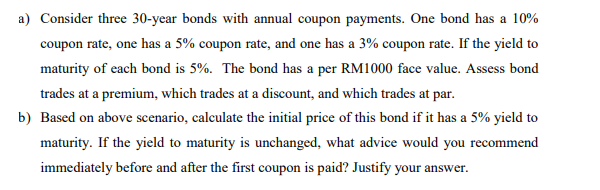

a) Consider three 30-year bonds with annual coupon payments. One bond has a 10% coupon rate, one has a 5% coupon rate, and one has a 3% coupon rate. If the yield to maturity of each bond is 5%. The bond has a per RM1000 face value. Assess bond trades at a premium, which trades at a discount, and which trades at par. b) Based on above scenario, calculate the initial price of this bond if it has a 5% yield to maturity. If the yield to maturity is unchanged, what advice would you recommend immediately before and after the first coupon is paid? Justify your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts