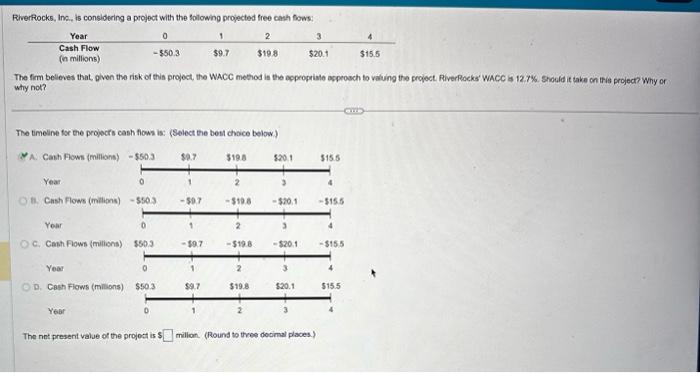

Question: Riverkocks, Ins. is considering a project with the solowing projected free cash fows: The fim believes that, given the risk of this project, the WACC

Riverkocks, Ins. is considering a project with the solowing projected free cash fows: The fim believes that, given the risk of this project, the WACC method is the ecpropriale acpeosch to viluing the project RiverRacks' WACC is 12.7%. Should it take on tris project? Why or why not? The timeline tor the projecrs cash fiow is: (Select the best chnice below.) A. Cash Flows (milions) Year 6. Cash Flows (millions) Yoar c. Cash Fows (milions) Year D. Cash Flows (milions) Year The net present value of the projoct is $ millon. (Round to three docimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts