Question: RiverRocks realizes that it will have to raise the financing for the acquisition of Raft Adventures (described in Problems 20 and 21) by issuing new

RiverRocks realizes that it will have to raise the financing for the acquisition of Raft Adventures (described in Problems 20 and 21) by issuing new debt and equity. River-Rocks estimates that the direct issuing costs will amount to $7 million. How should it account for these costs in evaluating the project? Should RiverRocks go ahead with the project? Answer this question just post the Question 20& 21 for reference

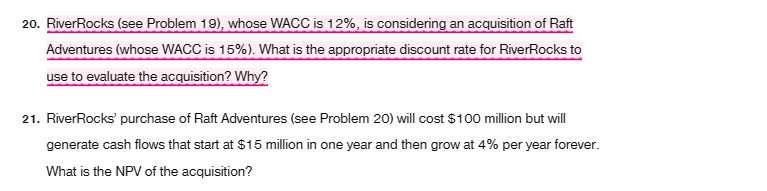

20. RiverRocks (see Problem 19), whose WACC is 12%, is considering an acquisition of Raft Adventures (whose WACC is 15\%). What is the appropriate discount rate for RiverRocks to use to evaluate the acquisition? Why? 21. RiverRocks' purchase of Raft Adventures (see Problem 20) will cost $100 million but will generate cash flows that start at $15 million in one year and then grow at 4% per year forever. What is the NPV of the acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts