Question: RMI 5051 Managing Risk Homework Assignment Week 5 40 points Due before our Zoom session Submit via Canvas Week 5 Individual Risk Management Case Decision:

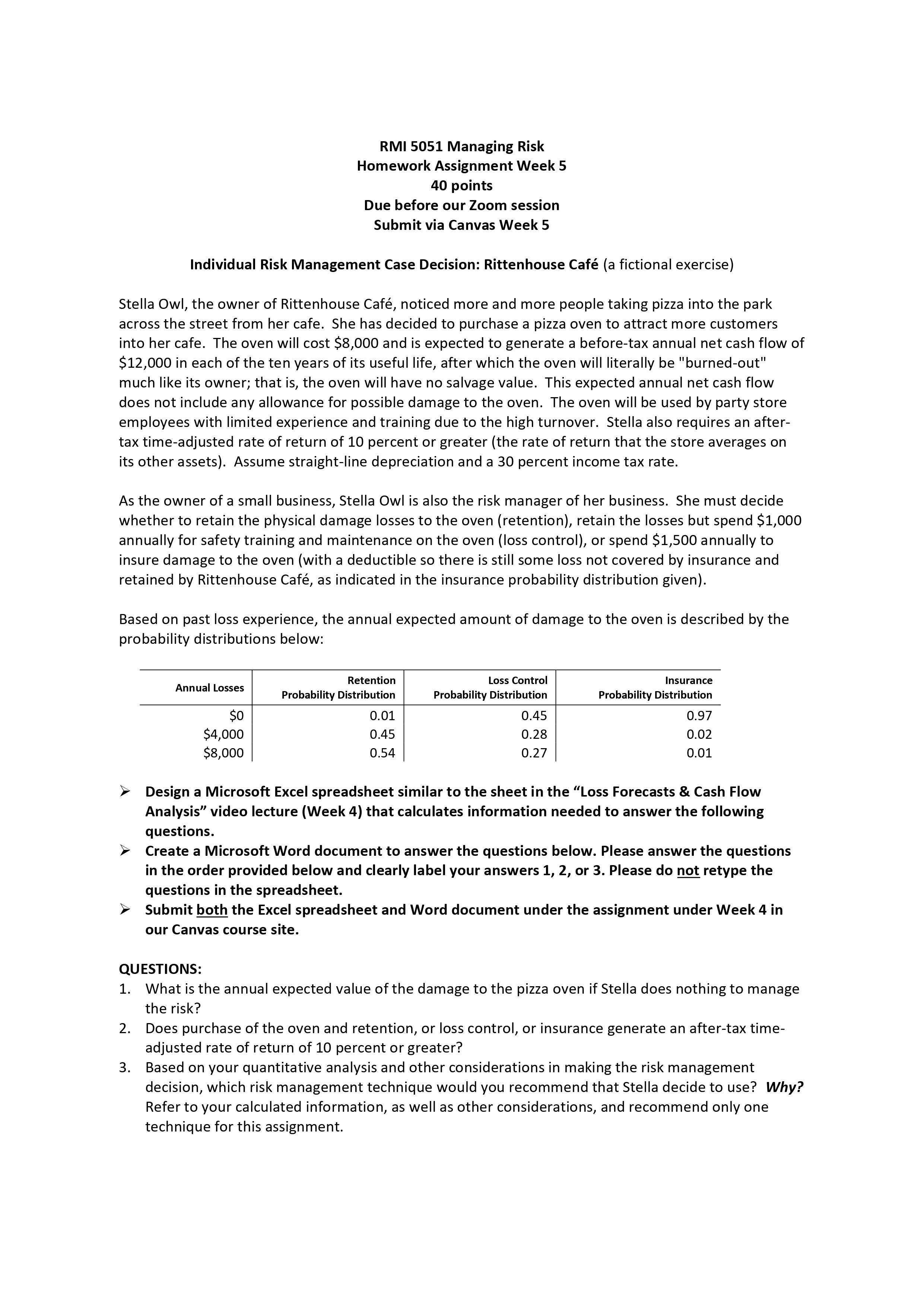

RMI 5051 Managing Risk Homework Assignment Week 5 40 points Due before our Zoom session Submit via Canvas Week 5 Individual Risk Management Case Decision: Rittenhouse Caf (a fictional exercise) Stella Owl, the owner of Rittenhouse Caf, noticed more and more people taking pizza into the park across the street from her cafe. She has decided to purchase a pizza oven to attract more customers into her cafe. The oven will cost $8,000 and is expected to generate a before-tax annual net cash flow of $12,000 in each of the ten years of its useful life, after which the oven will literally be "burned-out" much like its owner; that is, the oven will have no salvage value. This expected annual net cash flow does not include any allowance for possible damage to the oven. The oven will be used by party store employees with limited experience and training due to the high turnover. Stella also requires an after- tax timeadjusted rate of return of 10 percent or greater (the rate of return that the store averages on its other assets). Assume straightline depreciation and a 30 percent income tax rate. As the owner of a small business, Stella Owl is also the risk manager of her business. She must decide whether to retain the physical damage losses to the oven (retention), retain the losses but spend $1,000 annually for safety training and maintenance on the oven (loss control), or spend $1,500 annually to insure damage to the oven (with a deductible so there is still some loss not covered by insurance and retained by Rittenhouse Caf, as indicated in the insurance probability distribution given). Based on past loss experience, the annual expected amount of damage to the oven is described by the probability distributions below: Annual Losses Retention \"'55 Control Insurance Probability Distribution Probability Distribution Probability Distribution $0 0.01 0.45 0.97 $4,000 0.45 0.28 0.02 $8,000 0.54 0.27 0.01 > Design a Microsoft Excel spreadsheet similar to the sheet in the "Loss Forecasts & Cash Flow Analysis" video lecture (Week 4) that calculates information needed to answer the following questions. > Create a Microsoft Word document to answer the questions below. Please answer the questions in the order provided below and clearly label your answers 1, 2, or 3. Please do n_ot retype the questions in the spreadsheet. > Submit both the Excel spreadsheet and Word document under the assignment under Week 4 in our Canvas course site. QUESTIONS: 1. What is the annual expected value of the damage to the pizza oven if Stella does nothing to manage the risk? 2. Does purchase of the oven and retention, or loss control, or insurance generate an after-tax time- adjusted rate of return of 10 percent or greater? 3. Based on your quantitative analysis and other considerations in making the risk management decision, which risk management technique would you recommend that Stella decide to use? Why? Refer to your calculated information, as well as other considerations, and recommend only one technique for this assignment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts