Question: rm's capital structure does not affect its free cash flows because FCF reflects rang cash flows, which are available to service debt, to pay dividends

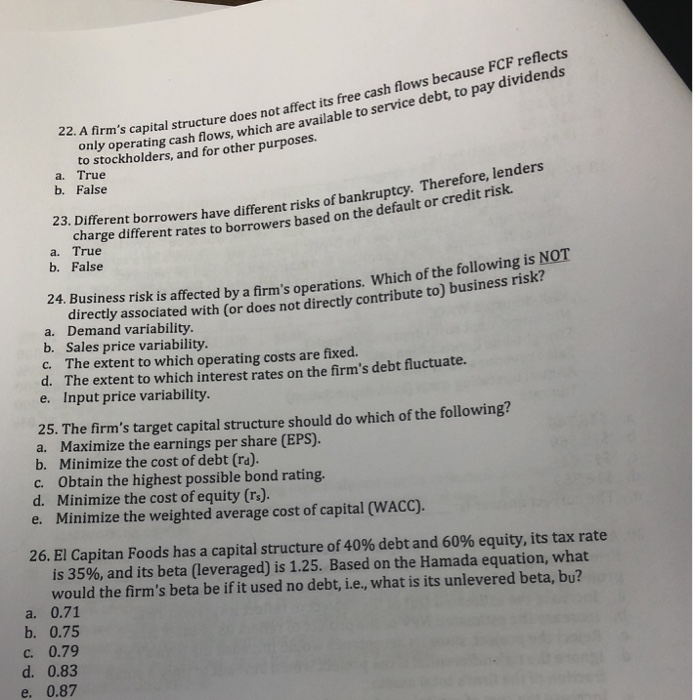

rm's capital structure does not affect its free cash flows because FCF reflects rang cash flows, which are available to service debt, to pay dividends only operatin lders, and for other purposes a. True b. False . Therefore, lenders 23. Different borrowers have different risks of bankruptcy charge different rates to borrowers based on the default or c a. True b. False 24. Business risk is affected by a firm's operations. Which of the following is NOT irectiy associated with (or does not directly contribute to) business risk? a. Demand variability. b. Sales price variability. The extent to which operating costs are fixed. d. c. The extent to which interest rates on the firm's debt fluctuate. e. Input price variability 25. The firm's target capital structure should do which of the following? a. Maximize the earnings per share (EPS). b. Minimize the cost of debt (ra). c. Obtain the highest possible bond rating. d. Minimize the cost of equity (rs). Minimize the weighted average cost of capital (WACC). e. 26, El Capitan Foods has a capital structure of 40% debt and 60% equity, its tax rate is 35%, and its beta (leveraged) is 1.25. Based on the Hamada equation, what would the firm's beta be if it used no debt, ie, what is its unlevered beta, bu? 0.71 b. 0.75 c. 0.79 d. 0.83 e. 0.87

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts