Question: rn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 5 Calculator E Print Item Instructions Form 1040 Schedule 1 Schedule 4 Schedule 5 Schedule B Schedule c Schedule D Instructions Note: This problem

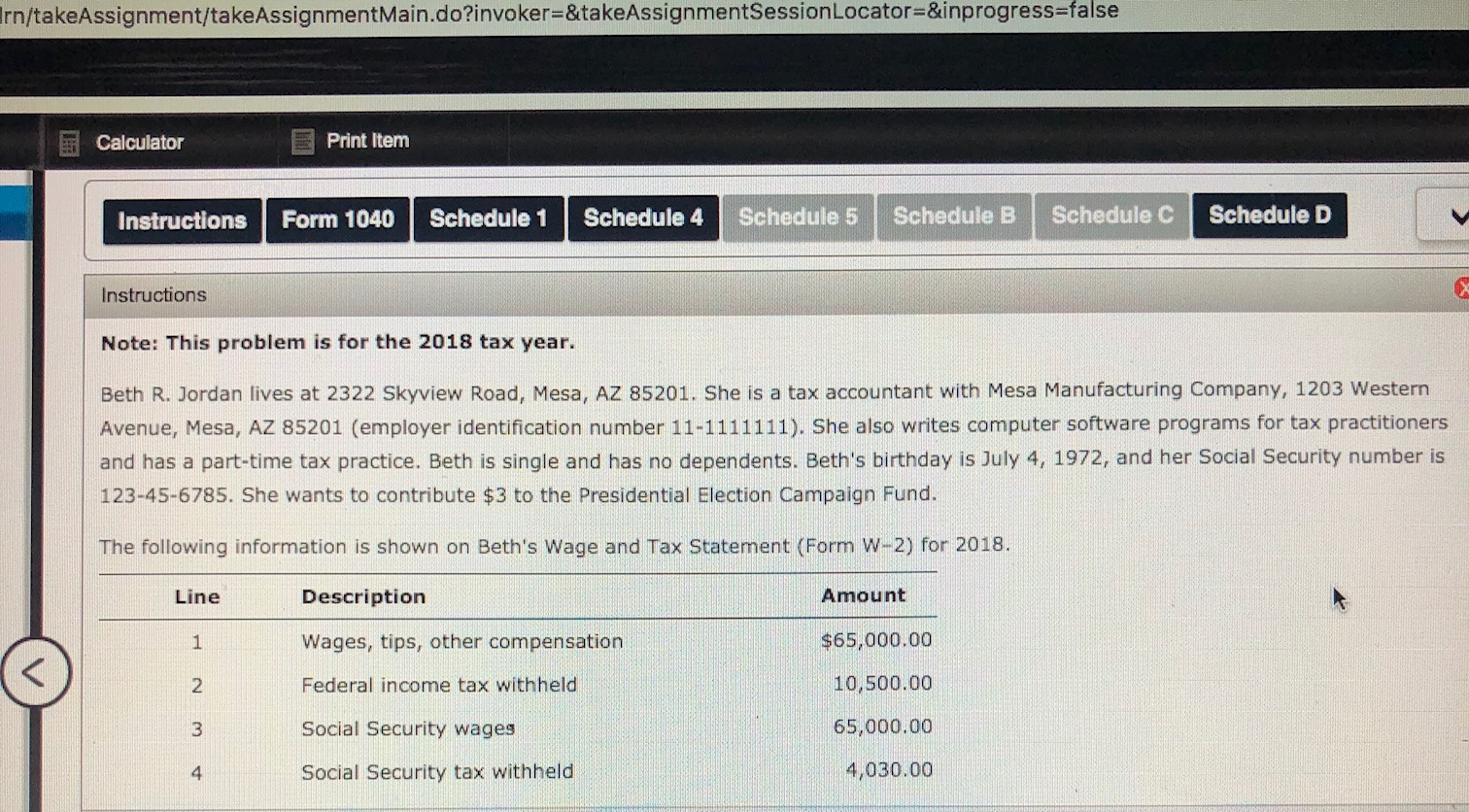

rn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 5 Calculator E Print Item Instructions Form 1040 Schedule 1 Schedule 4 Schedule 5 Schedule B Schedule c Schedule D Instructions Note: This problem is for the 2018 tax year. Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accountant with Mesa Manufacturing Company, 1203 Western Avenue, Mesa, AZ 85201 (employer identification number 11-1111111). She also writes computer software programs for tax practitioners and has a part-time tax practice. Beth is single and has no dependents. Beth's birthday is July 4, 1972, and her Social Security number is 123-45-6785. She wants to contribute $3 to the Presidential Election Campaign Fund. The following information is shown on Beth's Wage and Tax Statement (Form W-2) for 2018. Line Description Amount Wages, tips, other compensation Federal income tax withheld $65,000.00 10,500.00 65,000.00 4,030.00 Social Security wages Social Security tax withheld rn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false 5 Calculator E Print Item Instructions Form 1040 Schedule 1 Schedule 4 Schedule 5 Schedule B Schedule c Schedule D Instructions Note: This problem is for the 2018 tax year. Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accountant with Mesa Manufacturing Company, 1203 Western Avenue, Mesa, AZ 85201 (employer identification number 11-1111111). She also writes computer software programs for tax practitioners and has a part-time tax practice. Beth is single and has no dependents. Beth's birthday is July 4, 1972, and her Social Security number is 123-45-6785. She wants to contribute $3 to the Presidential Election Campaign Fund. The following information is shown on Beth's Wage and Tax Statement (Form W-2) for 2018. Line Description Amount Wages, tips, other compensation Federal income tax withheld $65,000.00 10,500.00 65,000.00 4,030.00 Social Security wages Social Security tax withheld

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts