Question: Robert Boyle & Associates - Mini Case On a Saturday afternoon in May 20XY, Robert Boyle and his wife Janet were sitting on the porch

Robert Boyle & Associates - Mini Case

On a Saturday afternoon in May 20XY, Robert Boyle and his wife Janet were sitting on the porch of their house on Saltsprings Island, British Columbia, watching the fog roll in. The couple frequently spent weekends on the island when the demands of Robert's business and Janet's teaching job would permit. Robert was the president of Robert Boyle & Associates, a closely held real estate investment trust (REIT) located in Vancouver. From a small office there, Robert had been managing the development of shopping centers for a little of eight years. Robert conducted most of the business himself, and the "associates," a group of about 40 friends, family member, and business colleague, provided most of the financing. The trust had been quite successful, and today it owned two shopping centers, which produced rental income in 20XX of almost $6 million. (See Table 1 and 2 for Boyle & Associates' financial statement for 20XX)

Table 1

Robert Boyle & Associates

Income Statement

For the Year Ending 20XX

(in millions)

Loan income.......................................................... $ 0.240

Rental income.....................................................5.992

Other income.....................................................0.168

Total income.................................................6.400

Amortization......................................................0.920

General and administrative expense............ 0.435

Operating income...........................................5.045

Interest expense.............................................0.945

Net income.................................................. 4.100

Dividend paid.................................................. 4.100

Table 2

Robert Boyle & Associates

Balance Sheet

As of December 31, 20XX

(in millions)

Assets

Cash and equivalents................................................. $ 2.100

Land development and construction loans........... 2.000

Property owned, net of amortization......................16.000

Other assets.................................................................0.900

Total assets....................................................................$21,000

Liabilities and Equity

Bank borrowings.......................................................... $ 2.000

Mortgages on property.............................................7.000

Other liabilities ..........................................................0.550

Total liabilities ..................................................... 9.550

Common stock..........................................................11.550

Retained earnings....................................................0.000

Total equity.......................................................... 11.550

Total liabilities and equity..........................................$21,000

"You know, Janet," Bob said wistfully, "we ought to move out here permanently. There's just no comparison between life here and on the mainland."

"You get no argument from me," Janet replied. "I've been telling you that ever since we bought this house."

"You could develop real estate just as easily from here as in the city, you know. Which reminds me, what is the latest on the Saltspring Center project? You've been quiet about it for about a week now." Janet referred to a proposal Robert had made a few months ago to build the first shopping center on Saltspring Island.

Robert sighed. "Well, it's on the back burner right now for lack of financing. I'm convinced that it would make us a lot of money; but, the trouble is, it will take a lot of money to get it built - about $10 million, in fact, and that's more than we've ever had to raise before."

"Oh, come on," Janet said. (She had always been an active participant in the business.) " You've built two shopping centers so far, and didn't have any trouble getting the money for them. Why don't you just borrow some more?"

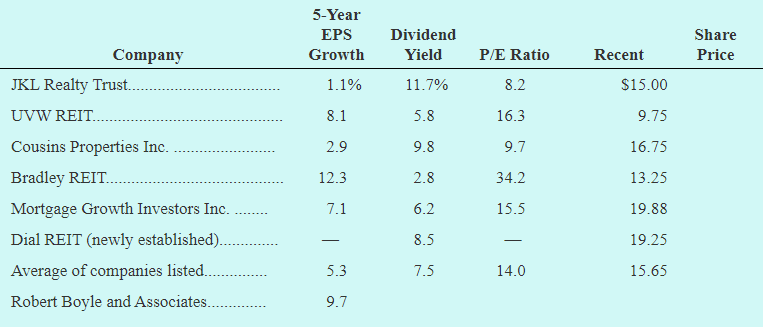

"Too much borrowed already, I'm afraid," Robert replied. " Our debt-to-assets ratio is quite a bit over the average for REITs now, and our investment dealer says that another loan, or even a bond issue, would be quite expensive in terms of interest cost." (See table 3 for comparisons between Boyle & Associates and a sample of other REITs.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts