Question: roblem 10.08 *Question 4 Check My Work (5 remaining) Click here to read the eBook: Basic Definitions Elick here to read the eBook: The Cost

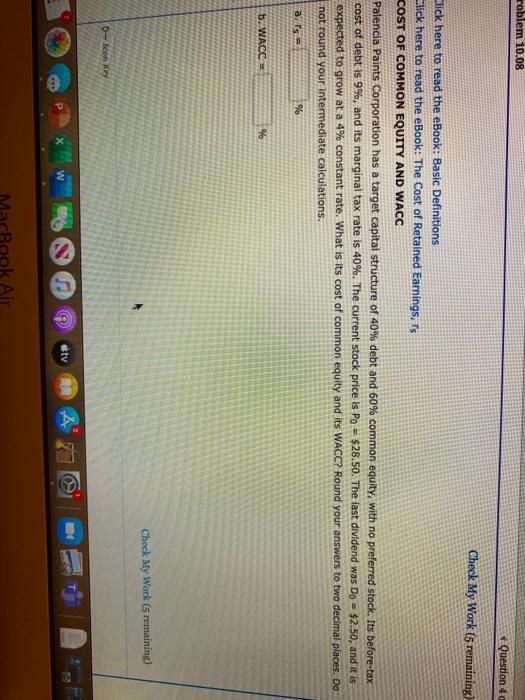

roblem 10.08 *Question 4 Check My Work (5 remaining) Click here to read the eBook: Basic Definitions Elick here to read the eBook: The Cost of Retained Earnings, is COST OF COMMON EQUITY AND WACC Palencia Paints Corporation has a target capital structure of 40% debt and 60% common equity, with no preferred stock. Its before-tax cost of debt is 9%, and its marginal tax rate is 40%. The current stock price is po = $28.50. The last dividend was Do = $2.50, and it is expected to grow at a 4% constant rate. What is its cost of common equity and its WACCP Round your answers to two decimal places. Do not round your intermediate calculations. al's % b. WACC = % Check My Work (5 remaining) 0 Icon Key w etv RA ok Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts