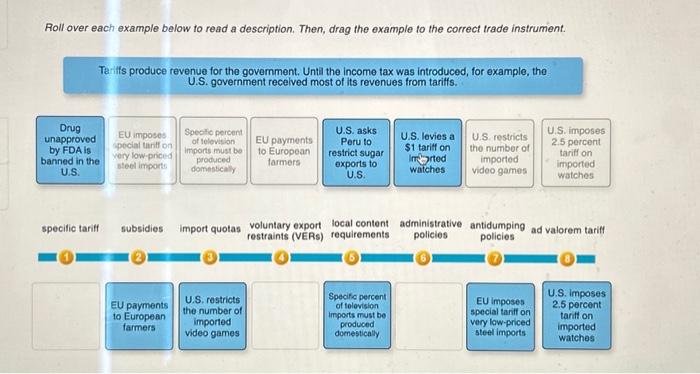

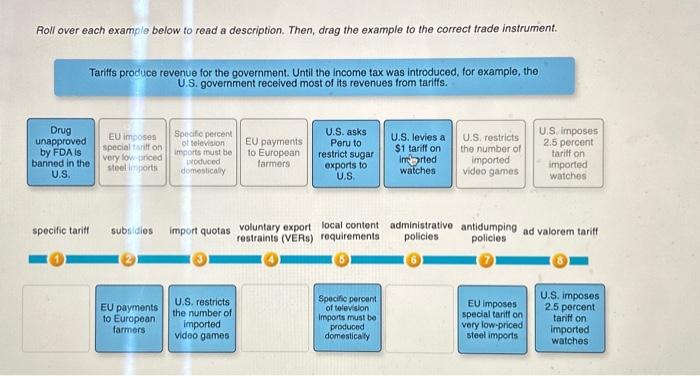

Question: Roll over each example below to read a description. Then, drag the example to the correct trade instrument. Tariffs produce revenue for the government. Until

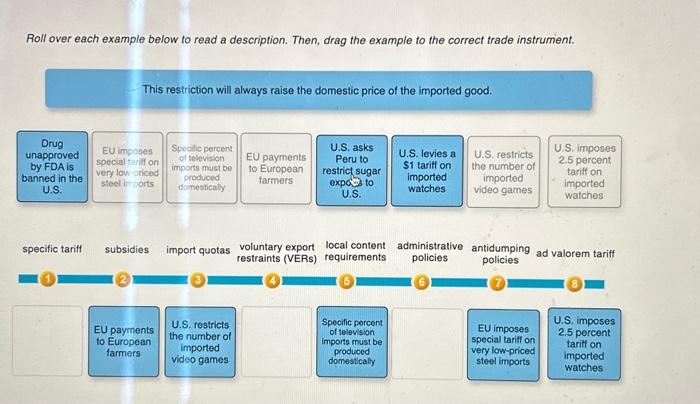

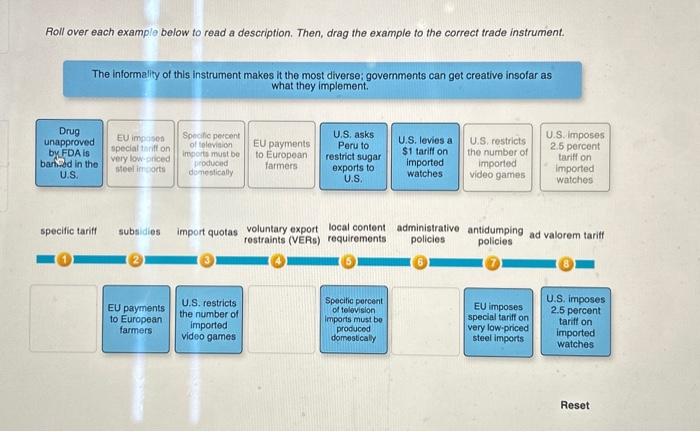

Roll over each example below to read a description. Then, drag the example to the correct trade instrument. This restriction will always raise the domestic price of the imported good. specific tariff subsidies import quotas voluntary export local content administrative antidumping ad valorem tariff restraints (VERs) requirements policies policies Roll over each examplo below to read a description. Then, drag the example to the correct trade instrument. The informality of this instrument makes it the most diverse; governments can get creative insofar as what they implement. Roll over each example below to read a description. Then, drag the example to the correct trade instrument. Teriffs produce revenue for the government. Until the income tax was introduced, for example, the U.S. government recelved most of its revenues from tariffs. specific tariff subsidies import quotas voluntaryexportlocalcontentadministrativeantidumpingadvaloremtariffrestraints(VERs)requirements Roll over each example below to read a description. Then, drag the example to the correct trade instrument. Tariffs produce revenue for the government. Until the income tax was introduced, for example, the U.S. government received most of its revenues from tariffs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts