Answered step by step

Verified Expert Solution

Question

1 Approved Answer

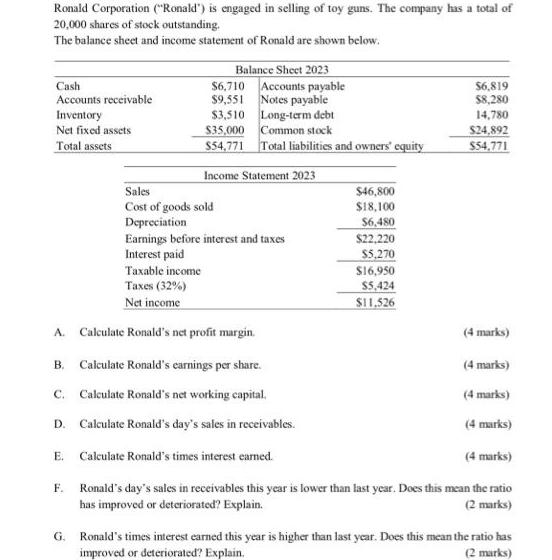

Ronald Corporation (Ronald') is engaged in selling of toy guns. The company has a total of 20,000 shares of stock outstanding. The balance sheet

Ronald Corporation ("Ronald') is engaged in selling of toy guns. The company has a total of 20,000 shares of stock outstanding. The balance sheet and income statement of Ronald are shown below. Cash Accounts receivable Inventory Net fixed assets Total assets Balance Sheet 2023 $6,710 $9,551 Sales Cost of goods sold Depreciation E. $3,510 $35,000 $54,771 Total liabilities and owners' equity Income Statement 2023 Accounts payable Notes payable A. Calculate Ronald's net profit margin. Long-term debt Common stock Earnings before interest and taxes Interest paid Taxable income Taxes (32%) Net income B. Calculate Ronald's earnings per share. C. Calculate Ronald's net working capital, D. $46,800 $18,100 $6,480 $22,220 $5,270 $16,950 $5,424 $11,526 $6,819 $8,280 14,780 $24,892 $54,771 (4 marks) (4 marks) (4 marks) (4 marks) Calculate Ronald's day's sales in receivables. Calculate Ronald's times interest earned. (4 marks) F. Ronald's day's sales in receivables this year is lower than last year. Does this mean the ratio has improved or deteriorated? Explain. (2 marks) G. Ronald's times interest earned this year is higher than last year. Does this mean the ratio has improved or deteriorated? Explain. (2 marks) H. Sometimes the financial ratios of different years of the same company are compared to analyze the company's financial situation (as in part F&G). What is this type of analysis called? (1 marks)

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTIONS A Net profit margin Net Income Sales x 100 5424 46800 x 100 116 B Earnings per share Net I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started