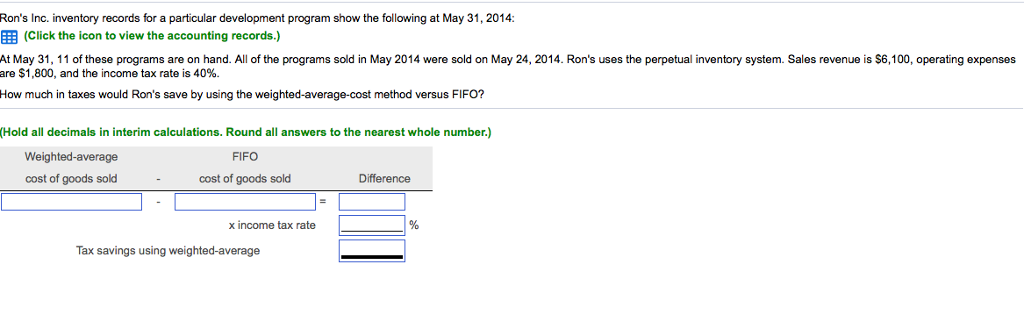

Question: Ron's Inc. inventory records for a particular development program show the following at May 31, 2014: EEE (Click the icon to view the accounting records.)

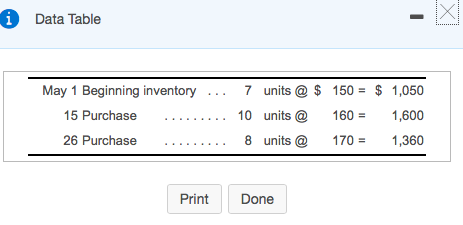

Ron's Inc. inventory records for a particular development program show the following at May 31, 2014: EEE (Click the icon to view the accounting records.) At May 31, 11 of these programs are on hand. All of the programs sold in May 2014 were sold on May 24, 2014. Ron's uses the perpetual inventory system. Sales revenue is $6,100, operating expenses are $1,800, and the income tax rate is 40%. How much in taxes would Ron's save by using the weighted-average-cost method versus FIFO? Hold all decimals in interim calculations. Round all answers to the nearest whole number. Weighted average FIFO cost of goods sold cost of goods sold Difference x income tax rate Tax savings using weighted average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts