Question: Rossi is an aggressive bond trader. He is currently analysis two bonds for his next investment. The first bond, Bond Axel, is a highly

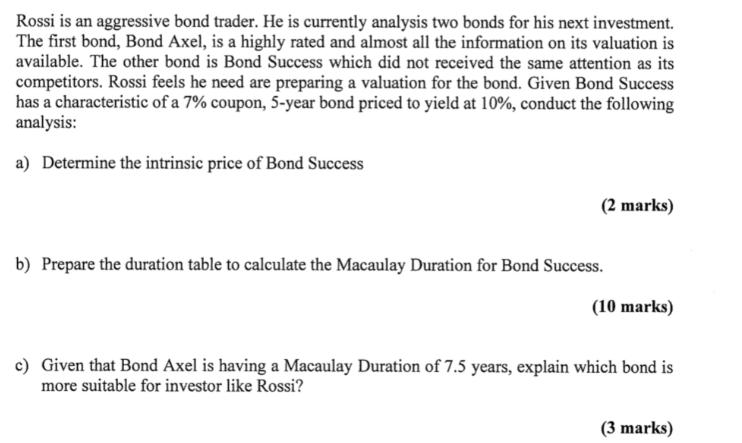

Rossi is an aggressive bond trader. He is currently analysis two bonds for his next investment. The first bond, Bond Axel, is a highly rated and almost all the information on its valuation is available. The other bond is Bond Success which did not received the same attention as its competitors. Rossi feels he need are preparing a valuation for the bond. Given Bond Success has a characteristic of a 7% coupon, 5-year bond priced to yield at 10%, conduct the following analysis: a) Determine the intrinsic price of Bond Success (2 marks) b) Prepare the duration table to calculate the Macaulay Duration for Bond Success. (10 marks) c) Given that Bond Axel is having a Macaulay Duration of 7.5 years, explain which bond is more suitable for investor like Rossi? (3 marks)

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

a To determine the intrinsic price of Bond Success we can use the present value formula for a bond I... View full answer

Get step-by-step solutions from verified subject matter experts