Question: RS PRINTER VERSION BACK RCES Question 13 [x You wer is incorrect. Try again. Blossom, Inc., has four-year bonds outstanding that pay a coupon rate

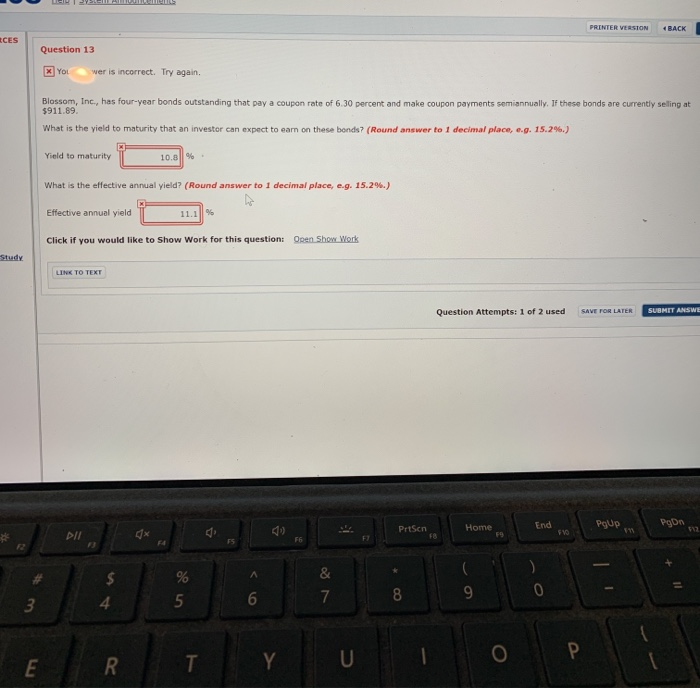

RS PRINTER VERSION BACK RCES Question 13 [x You wer is incorrect. Try again. Blossom, Inc., has four-year bonds outstanding that pay a coupon rate of 6.30 percent and make coupon payments semiannually. If these bonds are currently selling at $911.89 What is the yield to maturity that an investor can expect to earn on these bonds? (Round answer to 1 decimal place, e.g. 15.2%.) Yield to maturity 10.8% What is the effective annual yield? (Round answer to 1 decimal place, e.g. 15.2%.) Effective annual yield 11.1% Click if you would like to Show Work for this question: Open Show Work Study LINK TO TEXT Question Attempts: 1 of 2 used SAVE FOR LATER SUBMIT ANSWE Prtsen End Poon Pgup Home F9 PII 012 5V F6 F 12 ) $ % 5 & 7 8 9 0 3 6 4 o E R . Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts