Question: Rushton Precision Tools makes cutting tools for metalworking operations. It makes two types of tools: A6, a regular cutting tool, and EX4, a high-precision cutting

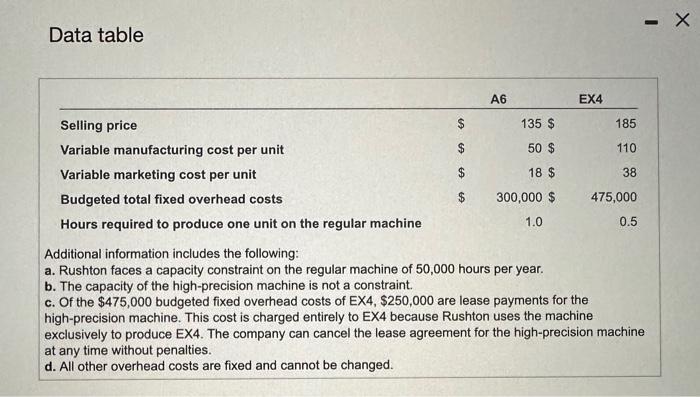

Rushton Precision Tools makes cutting tools for metalworking operations. It makes two types of tools: A6, a regular cutting tool, and EX4, a high-precision cutting tool. A6 is manufactured on a regular machine, but EX4 must be manufactured on both the regular machine and a high-precision machine. The following information is available:

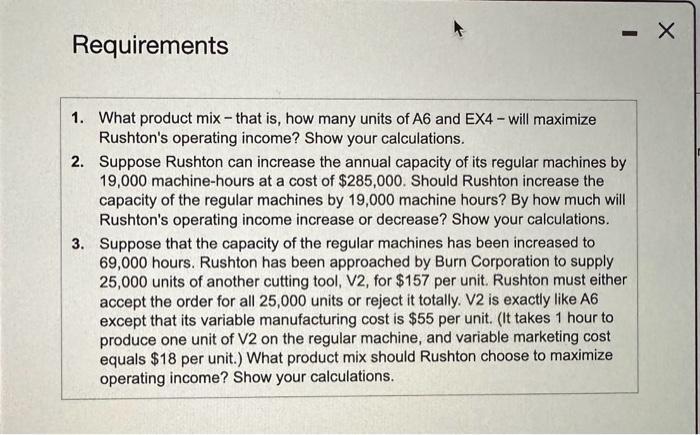

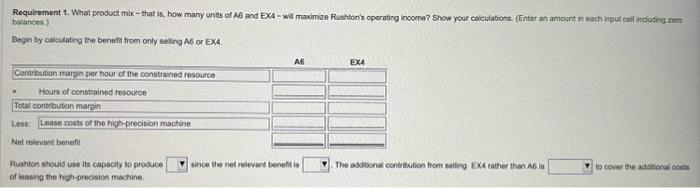

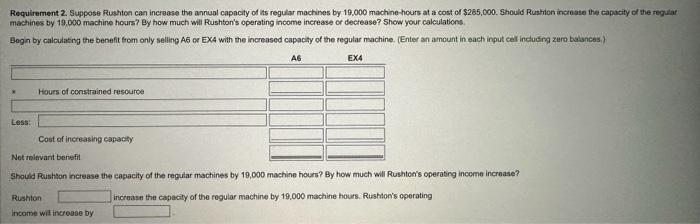

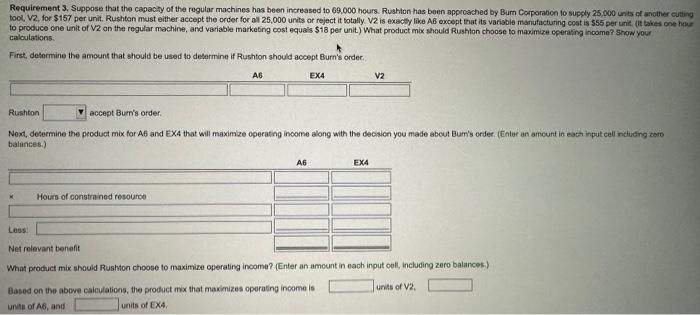

Data table Additional information includes the following: a. Rushton faces a capacity constraint on the regular machine of 50,000 hours per year. b. The capacity of the high-precision machine is not a constraint. c. Of the $475,000 budgeted fixed overhead costs of EX 4,$250,000 are lease payments for the high-precision machine. This cost is charged entirely to EX4 because Rushton uses the machine exclusively to produce EX4. The company can cancel the lease agreement for the high-precision machine at any time without penalties. d. All other overhead costs are fixed and cannot be changed. Requirements 1. What product mix - that is, how many units of A6 and EX4 - will maximize Rushton's operating income? Show your calculations. 2. Suppose Rushton can increase the annual capacity of its regular machines by 19,000 machine-hours at a cost of $285,000. Should Rushton increase the capacity of the regular machines by 19,000 machine hours? By how much will Rushton's operating income increase or decrease? Show your calculations. 3. Suppose that the capacity of the regular machines has been increased to 69,000 hours. Rushton has been approached by Burn Corporation to supply 25,000 units of another cutting tool, V2, for $157 per unit. Rushton must either accept the order for all 25,000 units or reject it totally. V2 is exactly like A6 except that its variable manufacturing cost is $55 per unit. (It takes 1 hour to produce one unit of V2 on the regular machine, and variable marketing cost equals $18 per unit.) What product mix should Rushton choose to maximize operating income? Show your calculations. Requirement 1. What product mix - that is, how many units of A6 and EX4 - will maximke Rushion's operating income? Show your calculations. (Enter an amount in esch hpuf celf induding zorm balances.) Begin by calculating the benefin from only seling A5 or EX4. \begin{tabular}{l} Contifution marpan per hour of the constraines resource \\ * Mours of constrainod resouroe \\ \hline Total controution margin \\ Less: Lease costs of the high-precision machine \\ Net relevant benefit \end{tabular} of leasing the high-precision machine. Requirement 2. Suppose Rushtion can increase the annual capacity of its regular machines by 19,000 machine-hours at a cost of $285,000. Should Rushton increase the capacity of the regular machines by 19,000 machine hours? By how much will Rushtor's operating income increase or decrease? Show your calculations. Begin by calculating the benefit from only selling A6 or EX4 with the increased capachy of the regular machine. (Enter an amount in each input celt incluoing zero balances.) Should Rushton increase the capacity of the regular machines by 19,000 machine hours? By how much will Rushtor's operabing income incroase? Rushton increase the capacily of the regular machine by 19,000 machine hours. Rushtoo's operating income wil incresse by Requirement 3. Suppose that the capacty of the regular machines has been increased to 69,000 hours. Rushton has been approached by Burn Corporation to supply 25,000 unts of another citting too, V2, for $157 per unit. Rushton must either accept the order for all 25,000 urits or reject it totally. V2 is exactly like AB except that its variabie manufacturing cost is 555 per unit, (it takes one hele to produce cne unit of V2 on the regular machine, and variable marketing cost equals $18 per unit) What product mix should Rushton choose to maximize operaing inoome? Show your caloutations: First, determine the amount that should be used to delarmine if Rushton should accept Burn's order. Rushton accept Burn's order. Next, determine the product mix for A6 and EX4 that will maximize operating income along with the decision you made about Bum's order. (Einter an amount in each input cell nituding coro balances.) What product mix should Rushton choose to maximize operating inoome? (Enter an amount in each input coll, including zero balances.) Based on the above calculations, the product mix that maximizes operating income is unts of V2, UnA: of A6, and units of EX4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts