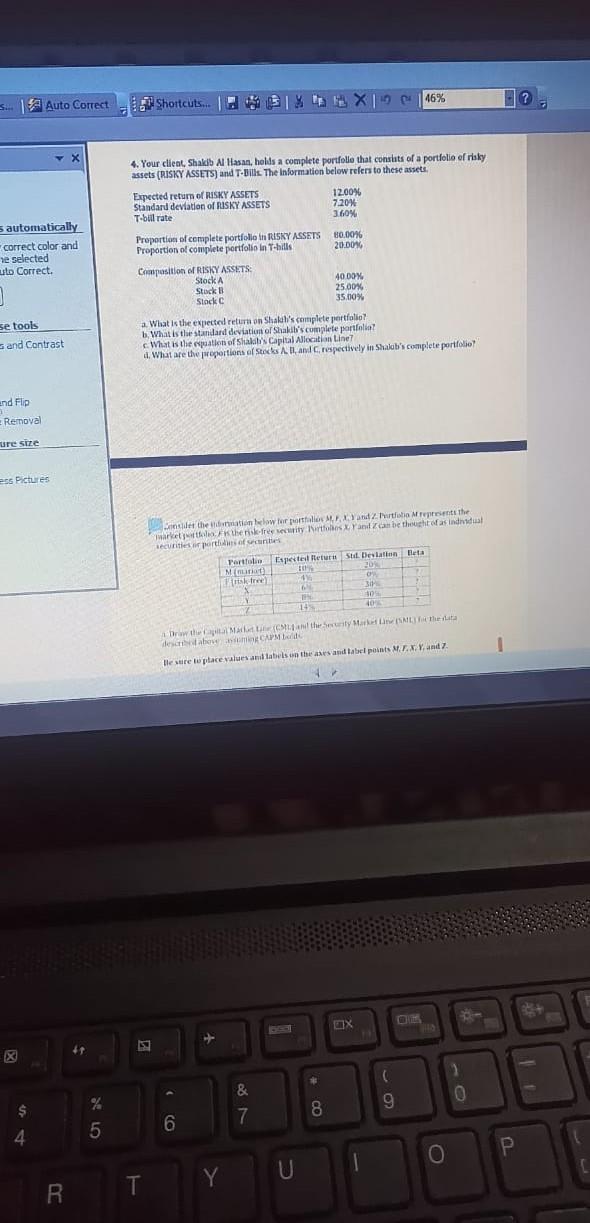

Question: S. Auto Correct Shortcuts. SIXTEE X 46% X 4. Your client, Shakib Al Hasan, holds a complete portfolle that constits of a portfolio of risky

S. Auto Correct Shortcuts. SIXTEE X 46% X 4. Your client, Shakib Al Hasan, holds a complete portfolle that constits of a portfolio of risky assets (RISKY ASSETS) and T-Bill. The Information below refers to these assets. Expected return of RISKY ASSETS Standard deviation of RUSKY ASSETS 7.20% T-bull rate 3.60% 12.00% 30.00% 20.00% s automatically correct color and se selected ulo Correct. Proportion of complete portfolio in RISKY ASSETS Proportion of complete portfolio in T-hills Composition of RISKY ASSETS Stock Stack Slack ] 40.00% 25.00% 35.00% se tools Sand Contrast a What is the expected return on Shalali's complete portfolio b. What is the standard deviation of Shakib's complete portfolia? What is the patients of Shal's Capital Allocation Line d. What are the proportions of SudA and respectively in Shalali's complete portfolio end Flip 2 Removal ure size es Pictures Let the nation below for profile and the Mupresent the We the free security to and can be thought of as individual securities ar portions Portfolio Esperted Retro Stil. Desiaton Meta Matat Title 3 10 14 O w that the heat Webowe Be sure to place values and labels on the axes and tabel points M.Z.XV. and 7 EX 2 ( 9 $ 8 6 7 4 5 O I R T . Y

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock