Question: S Corp uses the direct method for preparing its Statement of Cash Flows. 5 corp has a current and future income tax rate of

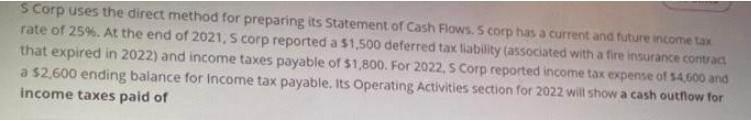

S Corp uses the direct method for preparing its Statement of Cash Flows. 5 corp has a current and future income tax rate of 25%. At the end of 2021, S corp reported a $1,500 deferred tax liability (associated with a fire insurance contract that expired in 2022) and income taxes payable of $1,800. For 2022, S Corp reported income tax expense of $4,600 and a $2,600 ending balance for Income tax payable. Its Operating Activities section for 2022 will show a cash outflow for income taxes paid of

Step by Step Solution

3.49 Rating (172 Votes )

There are 3 Steps involved in it

The cash outflow for income taxes paid in 2022 for 5 Corp will be 3700 Heres the ca... View full answer

Get step-by-step solutions from verified subject matter experts