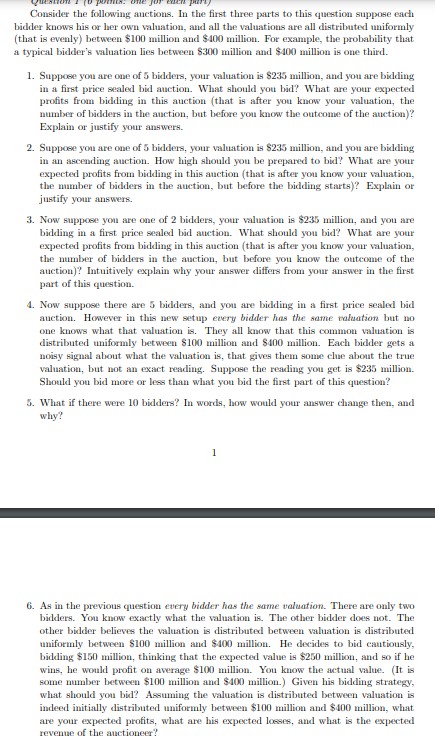

Question: ( S e e screenshot ) Consider the following bidder knows his o r her own valuation, and all the valuations are all distributed uniformly

screenshot Consider the following bidder knows his her own valuation, and all the valuations are all distributed uniformly

evenly between $ million and $ million. For example, the probability that a typical bidder's valuation lies between $ million and $ million one third.

Suppose you are one bidders, your valuation $ million, and you are bidding a first price sealed bid auction. What should you bid? What are your expected profits from bidding this auction after you know your valuation, the number bidders the auction, but before you know the outcome the auction Explain justify your answers.

Suppose you are one bidders, your valuation $ million, and you are bidding ascending auction. How high should you prepared bid? What are your expected profits from bidding this auction after you know your valuation,

the number bidders the auction, but before the bidding starts Explain justify your answers.

Now suppose you are one bidders, your valuation $ million, and you are bidding a first price sealed bid auction. What should you bid? What are your expected profits from bidding this auction after you know your valuation,

the number bidders the auction, but before you know the outcome the auction Intuitively explain why your answer differs from your answer the first part this question.

Now suppose there are bidders, and you are bidding a first price sealed bid auction. However this new setup every bidder has the same valuation but one knows what that valuation They all know that this common valuation distributed uniformly between $ million and $ million. Each bidder gets a noisy signal about what the valuation that gives them some clue about the true valuation, but not exact reading. Suppose the reading you get $ million. Should you bid more less than what you bid the first part this question?

What there were bidders? words, how would your answer change then, and why?

the previous question every bidder has the same valuation. There are only two bidders. You know exactly what the valuation The other bidder does not. The other bidder believes the valuation distributed between valuation distributed

uniformly between $ million and $ million. decides bid cautiously, bidding $ million, thinking that the expected value $ million, and wins, would profit average $ million. You know the actual value. some number between $ million and $ million. Given his bidding strategy, what should you bid? Assuming the valuation distributed between valuation indeed initially distributed uniformly between $ million and $ million, what

are your expected pro what are his expected losses, and what the expected revenue the auctioneer?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock