Question: s. How would increases in tolerable misstatement and assessed level of control risk affect the sample size in substantive tests of details? Increase in Increase

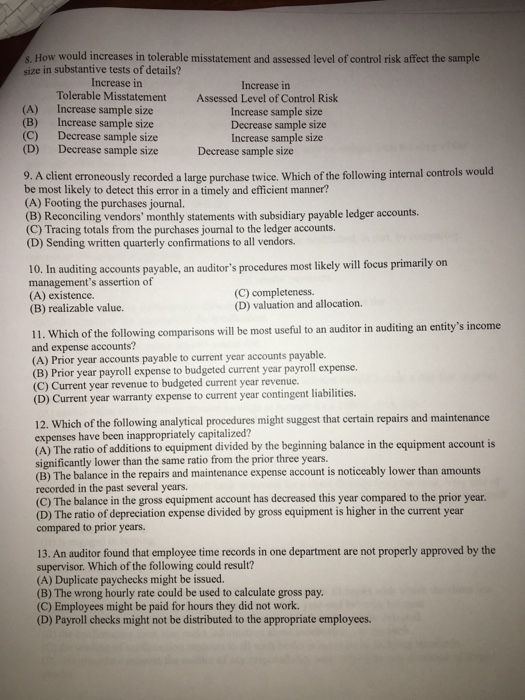

s. How would increases in tolerable misstatement and assessed level of control risk affect the sample size in substantive tests of details? Increase in Increase in Tolerable Misstatement Increase sample size Increase sample size Decrease sample size Decrease sample size Assessed Level of Control Risk (A) (B) (C) (D) Increase sample size Decrease sample size Increase sample size Decrease sample size 9. A client erroneously recorded a large purchase twice. Which of the following internal controls would be most likely to detect this error in a timely and efficient manner? (A) Footing the purchases journal. (B) Reconciling vendors' monthly statements with subsidiary payable ledger accounts. (C) Tracing totals from the purchases journal to the ledger accounts. (D) Sending written quarterly confirmations to all vendors. 10. In auditing accounts payable, an auditor's procedures most likely will focus primarily on management's assertion of (A) existence. (B) realizable value. (C) completeness. (D) valuation and allocation. 11. Which and expense accounts? (A) Prior year accounts payable to current year accounts payable. (B) Prior year payroll expense to budgeted current year payroll expense (C) Current year revenue to budgeted current year revenue. (D) Current year warranty expense to current year contingent liabilities. of the following comparisons will be most useful to an auditor in auditing an entity's income 12. Which of the following analytical procedures might suggest that certain repairs and maintenance expenses have been inappropriately capitalized? (A) The ratio of additions to equipment divided by the beginning balance in the equipment account is significantly lower than the same ratio from the prior three years. (B) The balance in the repairs and maintenance expense account is noticeably lower than amounts recorded in the past several years. (C) The balance in the gross equipment account has decreased this year compared to the prior year. (D) The ratio of depreciation expense divided by gross equipment is higher in the current year compared to prior years. 13. An auditor found that employee time records in one department are not properly approved by the supervisor. Which of the following could result? (A) Duplicate paychecks might be issued (B) The wrong hourly rate could be used to calculate gross pay (C) Employees might be paid for hours they did not work. (D) Payroll checks might not be distributed to the appropriate employees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts