Question: Case Study ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their

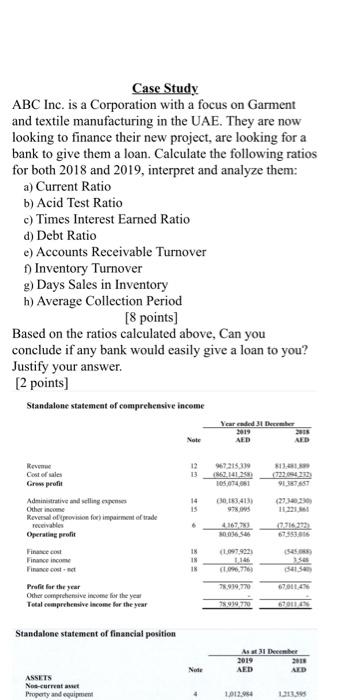

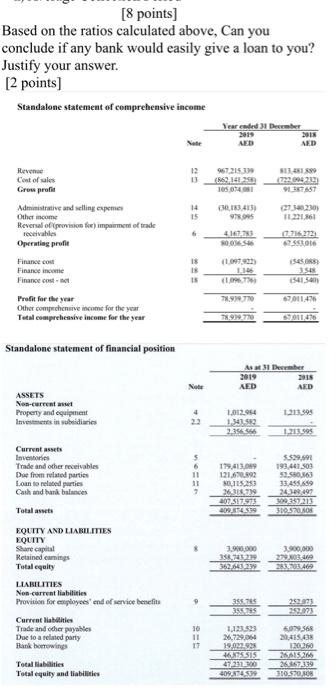

Case Study ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their new project, are looking for a bank to give them a loan. Calculate the following ratios for both 2018 and 2019, interpret and analyze them: a) Current Ratio b) Acid Test Ratio c) Times Interest Earned Ratio d) Debt Ratio e) Accounts Receivable Turnover f) Inventory Turnover g) Days Sales in Inventory h) Average Collection Period [8 points) Based on the ratios calculated above, Can you conclude if any bank would easily give a loan to you? Justify your answer. [2 points) Standalone statement of comprehensive income Yearded the Note AED AD 12 13 11. 967.215.399 8621412 100401 LEKTAST 14 15 1834133 97 Rev Cost of we Grow profil Administrative and selling expenses Otherine Reversal of provision for impairment of trade receivables Operating profil Finance Finance.com Finance cost 4167 MASS 02162022 6735106 IN 18 18 23 1146 09.7763 5415 7,979,770 670114 Profit for the year Other comprehensive incoene list the year Total comprehensive income for the year 78910270 6301 Standalone statement of financial position As the 2019 2018 AED AED Note ASSETS Nos current aut Property and equipment 2012.95 123.30 [8 points) Based on the ratios calculated above, Can you conclude if any bank would easily give a loan to you? Justify your answer. [2 points) Standalone statement of comprehensive income Vereaded 1 December 2019 2018 AED AED 967,215309 13 ZP2012) 9137857 105.04 Reven Cost of sales Grow profil Administrative and selling expenses Other income Reversal of provision for impairment of trade receive Operating profil 14 15 30,183 413) 97895 27.540.230) 163 SOONSUS 0.716.272 275510 is 15450 3 54154 15 1,096.77 Finance cost Finance income Finance cost Profit for the year Other comprehensive income for the year Total comprehensive income for the year 78.900 67011476 7.9.720 Standalone statement of financial position AS 31 December 2019 2018 AED AED Note ASSETS Non-current Property and equipment Investments in subsidiaries 4 123593 1012954 1.3415 23565 1-213.595 Current Inventories Trade and other receivables Dee from related parties Loan to related artis Cash and bank balances Total assets $ 6 11 11 7 179,413.09 121.69 0,115253 26318.79 SIMI 0330 $ $29.91 193 441 503 53.530.863 33.455 24.300 197 369.337.213 310.500 3.900.000 358,721 36M129 300.000 279.03.49 24 EQUITY AND LIABILITIES EQUITY Share capital Retained earnings Totally LIABILITIES Non-current liabilities Provision for employees' end of service benefits Current liabilities Trade and other payables Due to a related party Rank borowing Total abilities Total equity and liabilities . 355.75 3507 282073 293031 10 11 17 SON.568 ISAN 1307 1,2399 2.729054 19.02 46515 47.231300 409 414 26674119 310.5700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts