Question: s. Partial credit will be given. If you only provide the solution, then you receive little or no credit.) 29. A 3-year project initially requires

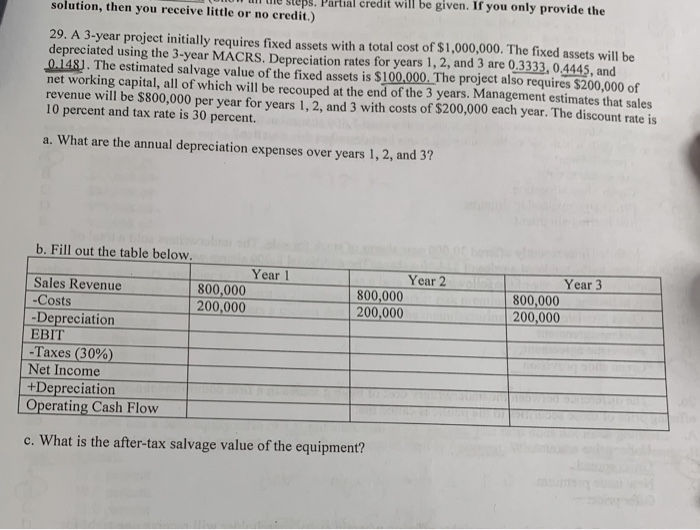

s. Partial credit will be given. If you only provide the solution, then you receive little or no credit.) 29. A 3-year project initially requires fixed assets with a total cost of $1,000,000. The fixed assets will be depreciated using the 3-year MACRS. Depreciation rates for years 1, 2, and 3 are 0.3333, 0,4445, and Oal481. The estimated salvage value of the fixed assets is $100,000. The project also requires $200,000 of net working capital, all of which will be recouped at the end of the 3 years. Management estimates that sales revenue will be $800,000 per year for years 1,2, and 3 with costs of $200,000 each year. The discount rate is 10 percent and tax rate is 30 percent. a. What are the annual depreciation expenses over years 1, 2, and 3? b. Fill out the table below. Year 3 Year 1 Year 2 Sales Revenue -Costs -Depreciation EBIT -Taxes (30% Net Income 800,000 200,000 800,000 200,000 800,000 200,000 +Depreciation Operating Cash Flow c. What is the after-tax salvage value of the equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts