Question: S(0)=0,43 1. Consider a one-period binomial tree model. The initial stock price is S(0). The price moves up by 1+u = 1.25 or down by

S(0)=0,43

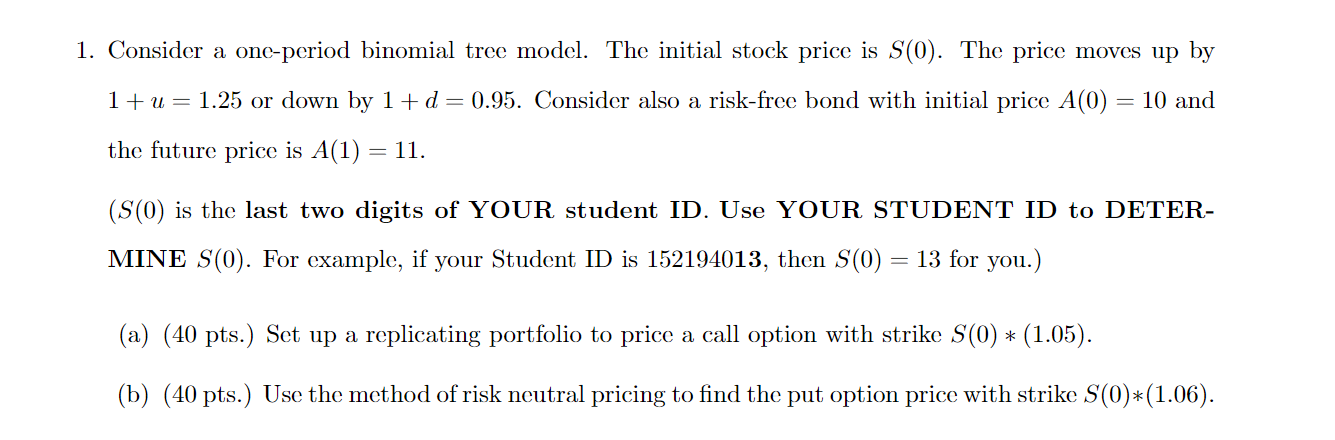

1. Consider a one-period binomial tree model. The initial stock price is S(0). The price moves up by 1+u = 1.25 or down by 1+d=0.95. Consider also a risk-free bond with initial price A(0) = 10 and the future price is A(1) = 11. (S(0) is the last two digits of YOUR student ID. Use YOUR STUDENT ID to DETER- MINE S(0). For example, if your Student ID is 152194013, then S(0) = 13 for you.) (a) (40 pts.) Set up a replicating portfolio to price a call option with strike S(0) * (1.05). (b) (40 pts.) Use the method of risk neutral pricing to find the put option price with strike S(0)*(1.06)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts