Question: S5-10 (open response) Question Help On August 31, 2018, Bart Tiemey borrowed $3,000 from Ferris State Bank. Tiemey signed a note payable, promising to pay

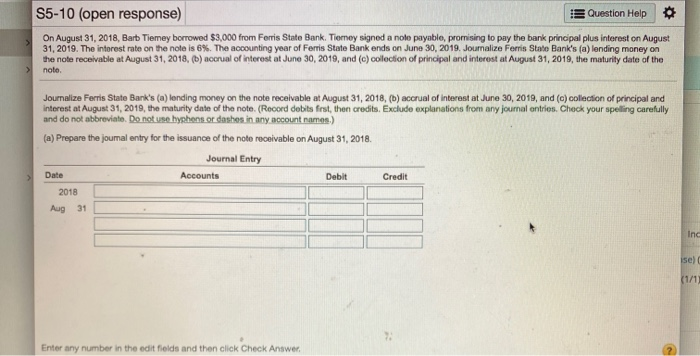

S5-10 (open response) Question Help On August 31, 2018, Bart Tiemey borrowed $3,000 from Ferris State Bank. Tiemey signed a note payable, promising to pay the bank principal plus interest on August 31, 2019. The interest rate on the note is 6%. The accounting year of Ferris State Bank ends on June 30, 2019. Journalize Ferris State Bank's (a) lending money on the note receivable at August 31, 2018. (b) accrual of interest at June 30, 2019, and (c) collection of principal and interest at August 31, 2019, the maturity date of the note Journalize Ferris State Bank's (a) londing money on the note receivable at August 31, 2018, (b) accrual of Interest at June 30, 2019, and (c) collection of principal and interest at August 31, 2019, the maturity date of the note. (Record debits frst, then credits. Exclude explanations from any journal entries. Check your spelling carefully and do not abbreviate. Do not use byphons or dashes in any account rames.) (a) Prepare the joumal entry for the issuance of the nobe receivable on August 31, 2018 Journal Entry Date Accounts Debit Credit 2018 Aug 31 Inc ise) (1/1) 2 Enter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts