Question: S5-10 (open response) Question Help On August 31, 2018, Becca Tallen borrowed $6,000 from Green State Bank. Tallen signed a note payable, promising to pay

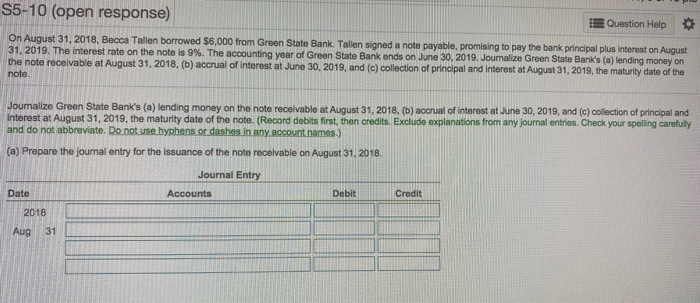

S5-10 (open response) Question Help On August 31, 2018, Becca Tallen borrowed $6,000 from Green State Bank. Tallen signed a note payable, promising to pay the bank principal plus interest on August 31, 2019. The interest rate on the note is 9%. The accounting year of Green State Bank ends on June 30, 2019. Journalize Green State Bank's (a) lending money on the note receivable at August 31, 2018. (b) accrual of interest at June 30, 2019, and (c) collection of principal and interest at August 31, 2019, the maturity date of the note. Joumalize Green State Bank's (a) lending money on the note receivable at August 31, 2018. (b) accrual of interest at June 30, 2019, and (c) collection of principal and interest at August 31, 2019, the maturity date of the note. (Record debits first, then credits. Exclude explanations from any journal entries. Check your spelling carefully and do not abbreviate. Do not use hyphensor dashesin any Count Domes.) (a) Prepare the journal entry for the issuance of the note recolvable on August 31, 2018 Journal Entry Accounts Debit Credit Date 2018 Aug 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts